- As Covid restrictions ease across the country, more people are heading back to the gym, new research shows.

- As of last month, traffic at gyms nationwide was back to 83% of January 2020 levels, and down just 6% from the same period in 2019, Jefferies found.

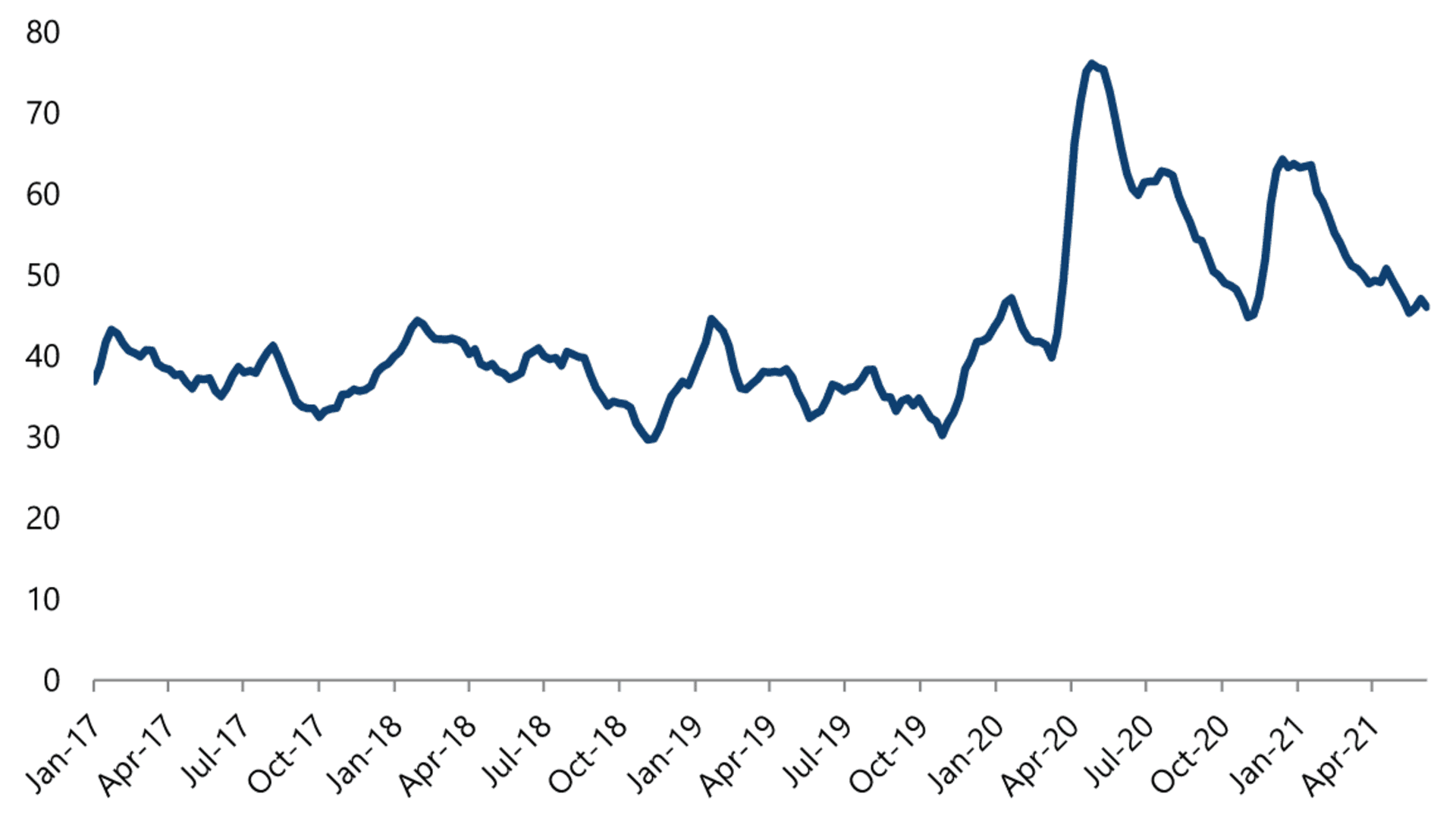

- Interest in at-home fitness equipment peaked in April 2020, Jefferies said, and has since decelerated to hit an all-time pandemic low.

As Covid restrictions ease across the country, vaccines are jabbed into arms and fitness centers revoke mask-wearing policies, more people are heading back to the gym, new research shows.

Jefferies has been tracking visits to fitness chains such as Planet Fitness and 24 Hour Fitness and monitoring online searches for gyms and digital fitness programs such as Peloton. While many Americans invested in the latter during the health crisis, aspiring to break a sweat at home, that demand appears to be fading.

Online searches for "gym near me" accelerated in May relative to April, Jefferies found, returning to all-time-high levels dating back to January 2020. Jefferies said the search interest in finding a gym close by mimics what is normally tracked at the start of the New Year — a time when many people commit to living a healthier lifestyle. The firm noted that searches for Crunch Fitness and Blink Fitness have rebounded the strongest among the national gym chains, year to date.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

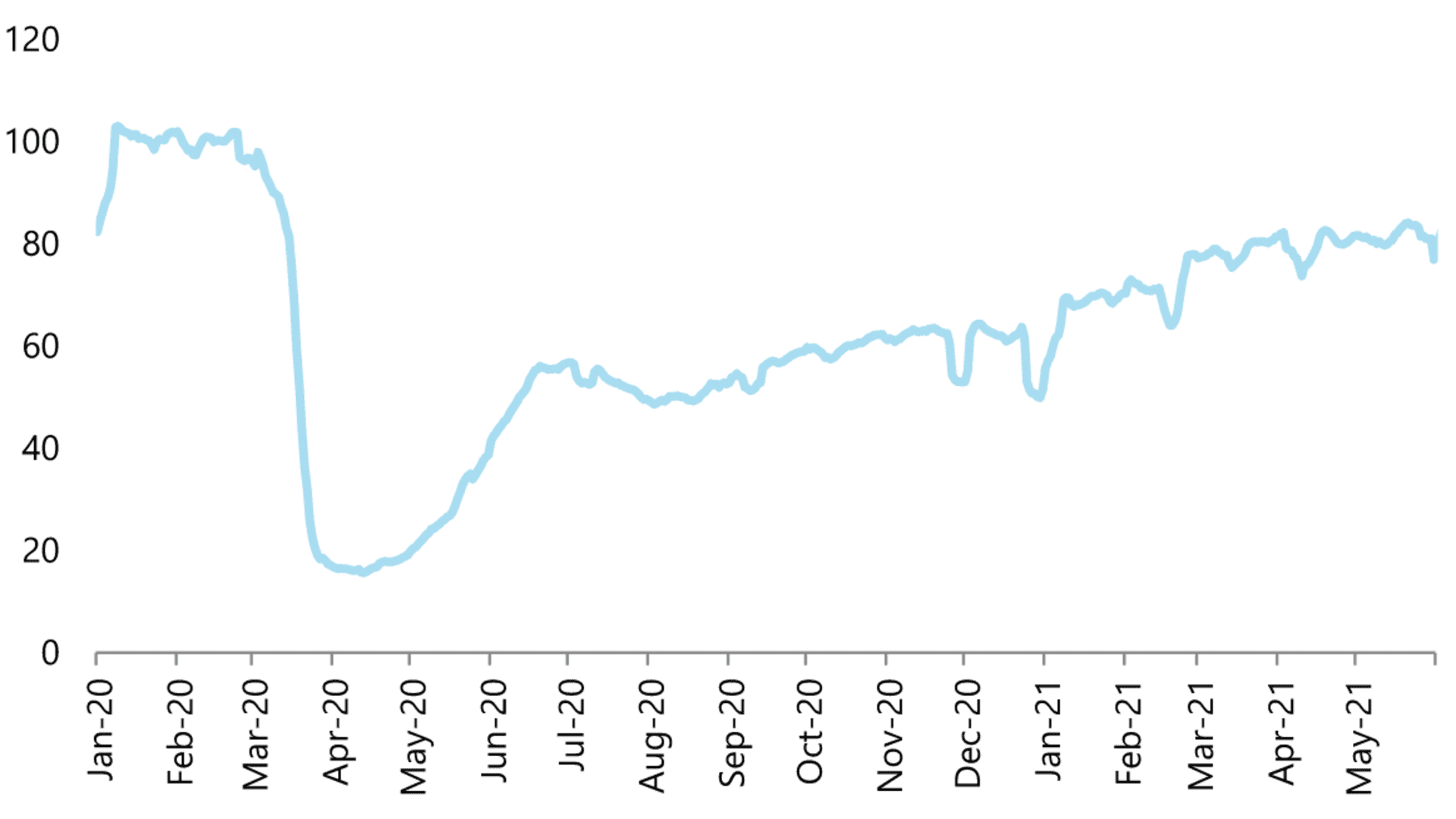

Traffic flow into fitness centers, meanwhile, has been steadily improving throughout this year. As of last month, Jefferies said, traffic at gyms nationwide was back to 83% of January 2020 levels and down just 6% from the same period in 2019.

Nationwide Fitness Center Traffic

Gym visits appear highest in Georgia, Florida and Texas, where Covid restrictions have been lighter compared with many states in the Northeast and along the West Coast, Jefferies noted.

Money Report

The high-end fitness chain Equinox is the biggest laggard in the group, likely impacted by its customers moving out to the suburbs, Jefferies added. Most of Equinox's locations are around the New York City area.

As more people leave the house to get back to the gym, searches for at-home fitness equipment and digital fitness players is moderating, according to Jefferies' research. The firm has been looking at searches for exercise balls, dumbbells, yoga mats, jumping ropes, massage guns, weights, foam rollers and exercise bikes. And interest has been tumbling since this past January.

At-home Fitness Equipment Interest

More internet users are visiting the websites of gym chains like Orangetheory Fitness — likely looking to rebook a membership or check out a location's mask policy — while traffic to digital workout platforms, such as Tonal and NordicTrack, is also decelerating. Interest in at-home fitness equipment peaked in April 2020, Jefferies said, and has since dropped to an all-time pandemic low.

"We believe that people will employ a hybrid approach, using the plethora of digital concepts and traditional gym experience," Jefferies analyst Randy Konik said. "Gyms that champion this model will emerge as winners in years to come."

Businesses including cycle manufacturer Peloton and rowing machine maker Hydrow — which reaped incredible benefits from consumers looking for at-home workout gear last year — are trying to find ways to keep the momentum growing. Peloton, for example, is expanding outside of the U.S. and continues to add new instructors and new content, such as Pilates, to its roster.

Peloton shares are down more than 28% year to date, while Planet Fitness' stock has dropped about 4% over the same time period.