Social media stocks are struggling.

The group sustained notable losses on Tuesday as part of the broader sell-off in technology plays, with Snap falling nearly 6%, Pinterest down 2% and Facebook declining more than 1%.

Twitter, which closed less than half of 1% lower on Tuesday, is now about 33% off its mid-February all-time highs. Pinterest and Snap are 31% and 24% off their record highs from the following week, respectively.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

Facebook has managed to hold onto its gains, just 4% from the high it hit after last week's earnings report. Two market analysts told CNBC on Tuesday the stock stands out.

"Though I have a tortured relationship with this management team — there's been some high-profile missteps, regulatory concerns — you can't argue with the business model," said Nancy Tengler, chief investment officer at Laffer Tengler Investments.

Facebook and Google parent Alphabet get the "lion's share" of the digital advertising market, which is expected to grow to 51% of all advertising spending this year, Tengler said on "Trading Nation."

Money Report

Moreover, Facebook is growing users, earnings per share and revenues on a relatively cheap 26 times price-to-earnings multiple, Tengler said.

"I think you use the weakness or the sort of lack of movement in the stock over the last six months as an opportunity to enter," she said. "We still own it, but we don't own it in our 12 best ideas portfolio."

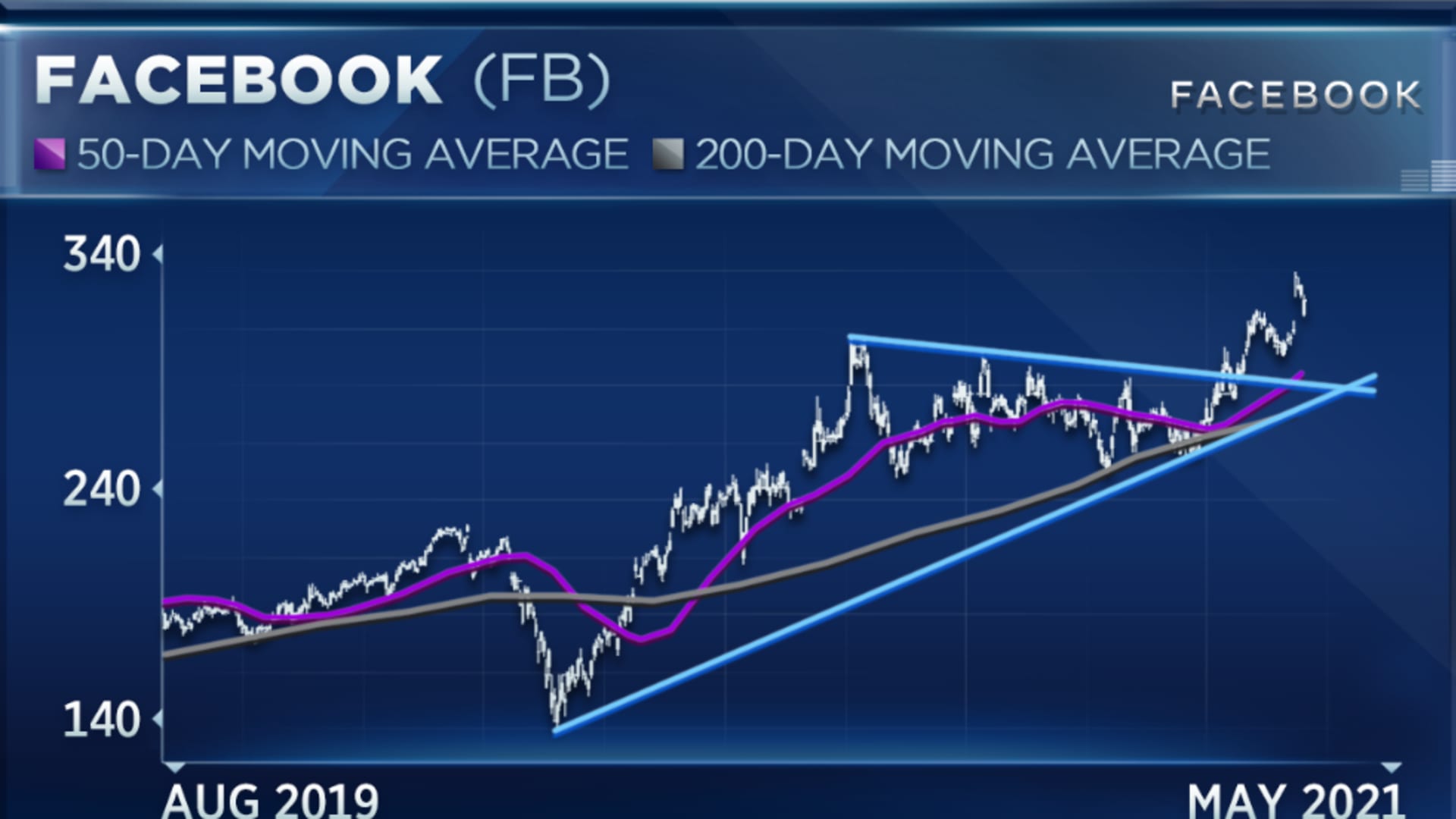

Though the market itself still needs time to "digest April's gains," Facebook does look like a better bet than the other social names, Blue Line Capital President and founder Bill Baruch said in the same "Trading Nation" interview.

"We would be looking to buy Facebook instead of Twitter now on some weakness," said Baruch, who owns Twitter shares.

"Facebook's a relatively cheap stock, and there's a lot of support that Facebook's moving into [in] the 285 area. You've got a lot of technical levels that align there," he said. "So as the broader market has some choppiness, ... I think Facebook would be the better buy as we work our way through the month of May."

Facebook ended trading at $318.36 on Tuesday.

Disclosure: Laffer Tengler Investments and Tengler own shares of Facebook and Alphabet. Baruch owns shares of Twitter and Alphabet.