- Tim Hortons same-store sales shrank during the first quarter as Canadian Covid-19 outbreaks weighed on the business.

- "Americans are experiencing a very different path out of Covid than Canadians," Restaurant Brands International CEO Jose Cil said.

- Tim Hortons was in turnaround mode even before the pandemic, and some of its investments are starting to pay off.

Canada's worsening wave of Covid-19 cases is putting pressure on Tim Hortons, the country's iconic coffee chain, and that could be hiding some of the progress its turnaround is making.

Parent company Restaurant Brands International is a popular stock among Wall Street analysts. Barclays Capital, for example, selected it as one of its top picks for medium- or long-term investors. Burger King and Popeyes are recovering quickly in the U.S., and a successful turnaround of Tim Hortons would fix the laggard of the portfolio.

So far this year, Restaurant Brand shares have risen 12%, giving the company a market value of $31.8 billion. The stock was up 1% in morning trading after its first-quarter earnings and revenue topped estimates.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

Tim Hortons was the only chain in Restaurant Brands' portfolio to report shrinking same-store sales, even as it faced a comparison with double-digit declines from a year earlier. Worldwide, its same-store sales fell 2.3%, and Canadian same-store sales dropped 3.3%. Tim Hortons' declining systemwide sales dragged down Restaurant Brands' organic revenue, which was negative compared with a year earlier. Typically, Tim Hortons contributes about 60% of Restaurant Brands' total revenue.

Restaurant Brands CEO Jose Cil said that there was "no doubt" that the biggest factor affecting the coffee chain's performance was the restrictions on mobility in Canada.

"Americans are experiencing a very different path out of Covid than Canadians," Cil said.

Both Burger King and Popeyes reported positive same-store sales growth in the United States.

Money Report

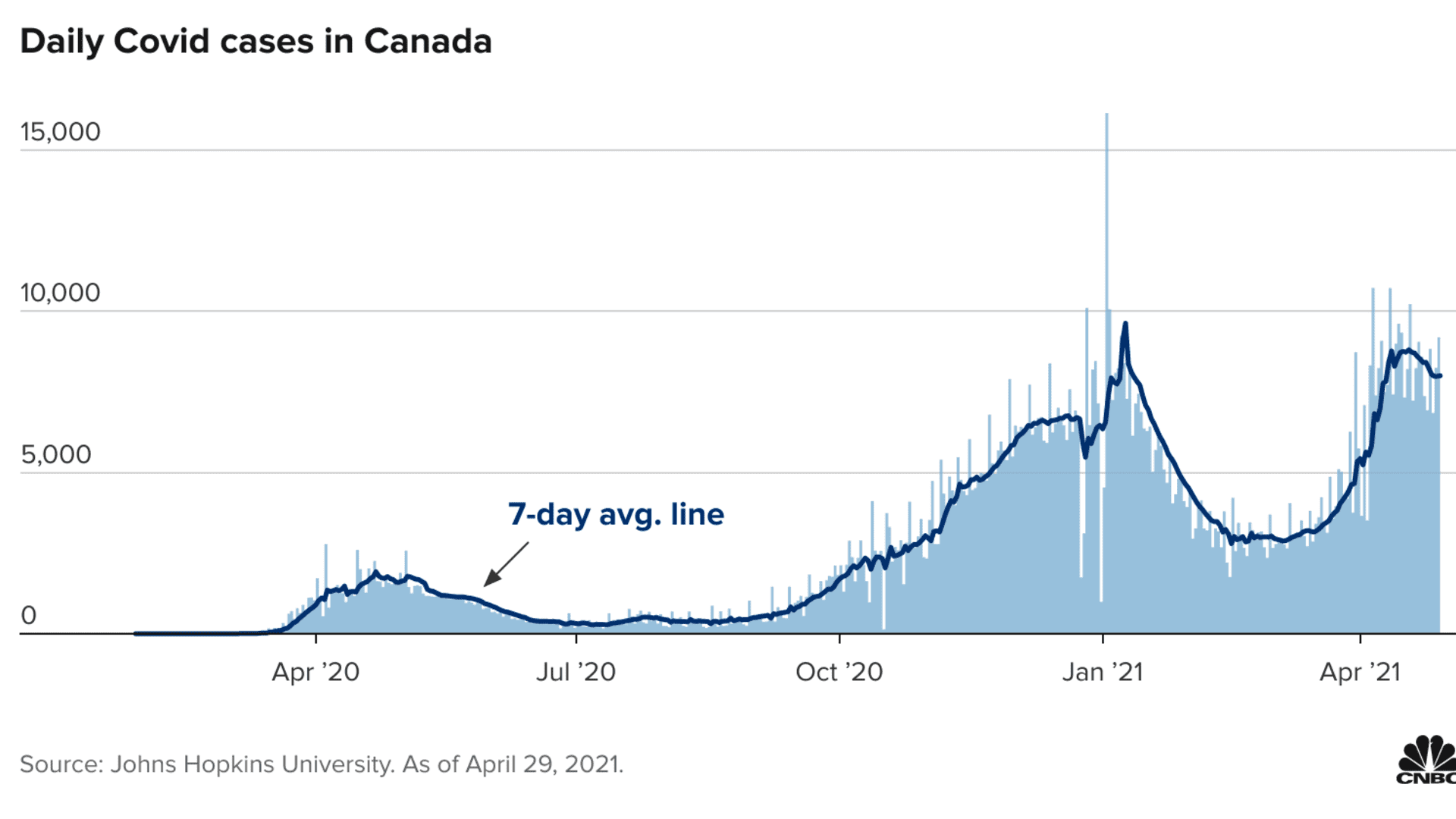

This month, Canada's rate of new Covid-19 infections overtook that of the U.S. for the first time since the pandemic began. Ontario, which is home to nearly 40% of the country's population and almost half of Tim Hortons' locations, is under a stay-at-home order until May 20. Cil told analysts on Friday that there is a "real possibility" that the mandate is extended.

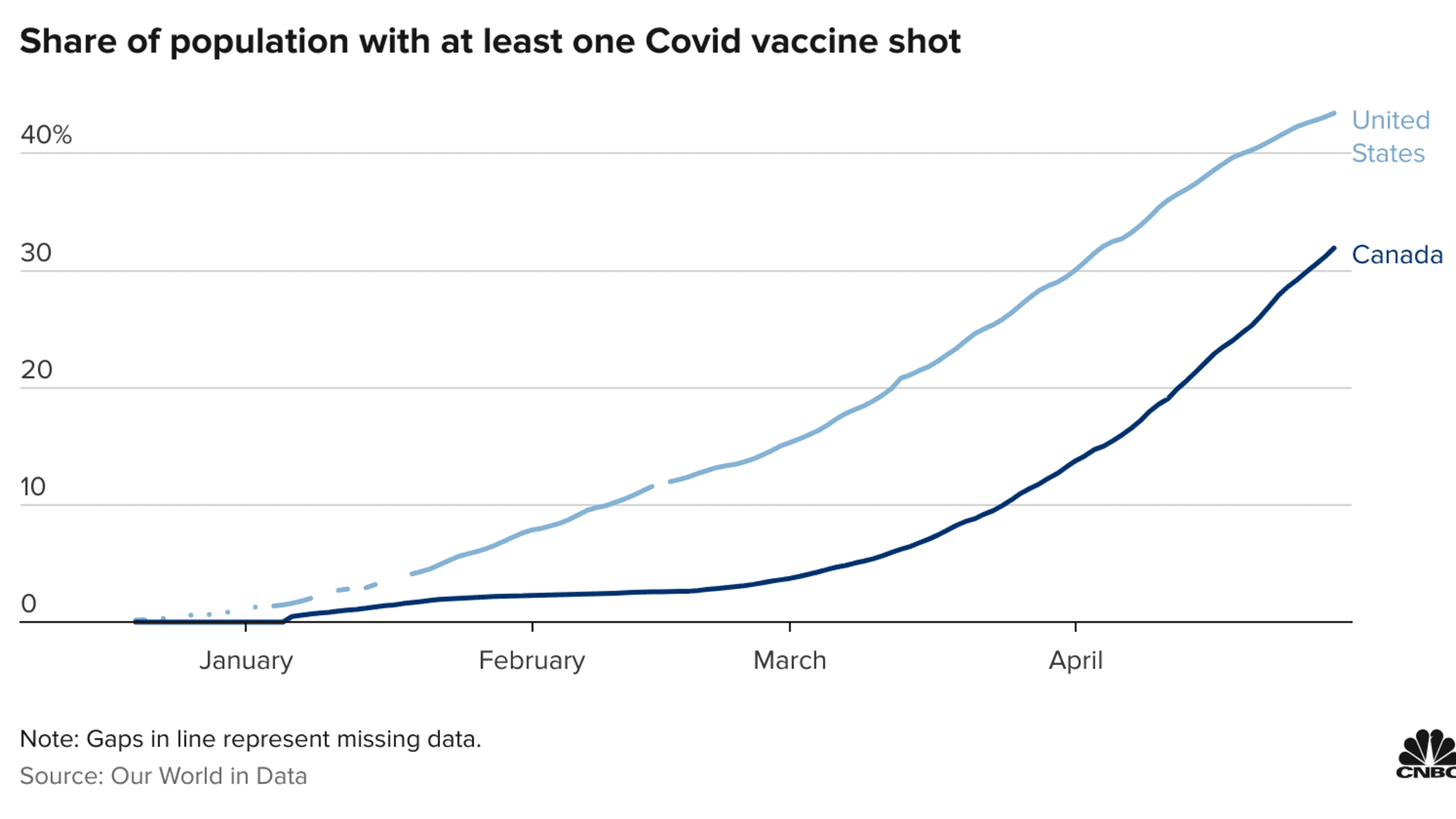

Canada's vaccine rollout has also been slower than that of the U.S., which has fully vaccinated 30% of the population, according to data from the Centers for Disease Control and Prevention. Ontario just opened up first-dose availability to people who are at least 40 years old, and it plans to accelerate eligibility to all adults by the end of May.

But there are some bright spots for Tim Hortons. In areas where Canadians can have more normal routines, consumers are returning to cafes. Suburban restaurants sales are flat to slightly up compared with the year-ago period, executives said. It also has about 1,000 more drive-thru locations in Canada than its competition, giving it the leg up on attracting consumers who are looking for convenient ways to pick up their coffee.

The chain was in turnaround mode even before the pandemic, and its continued investments in the business are starting to pay off. Its new dark roast coffee, coupled with upgraded coffee brewing equipment and water filtration, resulted in the highest increase in the percentage of transactions that included coffee in three years. Its fresh cracked egg breakfast sandwiches helped drive same-store sales growth for the breakfast category in February.

In March, Tim Hortons announced an investment of 80 million Canadian dollars ($65 million) to spend on advertising, new menu items and its loyalty program. Franchisees are also chipping in an additional 0.5% of sales into advertising contributions.