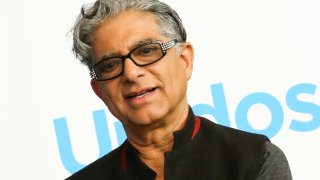

People need to pay attention to their total well-being, and if they don't the consequences could be dire, according to wellness expert and best-selling author Deepak Chopra.

Total well-being encompasses purpose — or career— social, physical, community and financial factors, he said. For example, community well-being can mean feeling safe and involved in your community, while social well-being can be the quality of the relationships you have with family and friend.

"Unless we address these five buckets of well-being … we are heading for global disaster," said Chopra, founder of both The Chopra Foundation and Chopra Global. He's also a member of the CNBC Invest in You Financial Wellness Council.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

More from Invest in You:

Covid piles more stress and financial strain on family caregivers

How to manage your money, boost your savings and start investing

Ramit Sethi: Ace your job interview with these 3 strategies

Financial health is more than just where you stand with your money. If you are financially stressed, it will send your cortisol levels up and weaken your immune system.

"You have inflammation going up, which makes you more susceptible to chronic and acute illness, even Covid-19," he said.

Money Report

Yet the pandemic is also the cause of financial anxiety for so many. Millions of jobs have been lost, pay has been cut and some parents had to leave the workforce to care for children.

More than 4 in 5 Americans, or 84%, are feeling stress on their personal finances due to the crisis, an October survey by the National Endowment for Financial Education found.

Another survey by Fidelity found that 79% of women, who typically suffer from more financial anxiety than men, feel weighed down by money and stress.

While there may be real reasons are anxious over money, financial well-being is ultimately a state of mind, said Chopra, whose latest book is "Total Meditation."

"It does not have to do with the amount of money you have, it has to do with how secure you feel with the money you have," he explained.

Here are Chopra's five tips for financial wellness:

- Don't spend money you have not earned to buy things that you don't need, to impress people you don't like.

- Put away 10% of your income every month. "I did that since 1970, when I was earning $202 a month."

- Find an employer who takes care of their employees and offers benefits like retirement, disability and insurance. Work with friends and people you like; otherwise, you won't be successful in your career.

- Don't ignore your body, mind and emotions. "If you have a healthy body, if you have good relationships emotionally and if you are a rested mind, you will make wise financial decisions."

- Make other people successful, which is the best way to be successful yourself. "I found in my career that if I could make other people make money, I would make money, as well."

Chopra says he strives every day to have a joyful, energetic body and compassionate heart, as well as a clear, reflective, alert and creative mind, and joy and lightness of being.

"If you are whole in your body, in your emotions, in your mind and in your spirit, you can accomplish anything, including have a very successful career and make lots of money," he said.

SIGN UP: Invest in You: Ready. Set. Grow. is hosting a free, Virtual 5k for Financial Wellness from April 12-19 to promote financial wellness. Throughout their race experience, users will receive saving, spending and investing tips as well as motivational quotes about financial well-being from wellness expert and CNBC Financial Wellness Advisory Council member Deepak Chopra. Sign up here: cnbc.com/virtual5k

SIGN UP: Money 101 is an 8-week learning course to financial freedom, delivered weekly to your inbox.

CHECK OUT: Here's how Americans meant to use their first 2 stimulus checks — and how they actually used them via Grow with Acorns+CNBC.

Disclosure: NBCUniversal and Comcast Ventures are investors in Acorns.