Check here for real-time updates of the U.S. stock market.

U.S. stocks rallied Wednesday, clawing back losses from earlier in the week, as traders cheered better-than-expected economic data that helped allay recession fears.

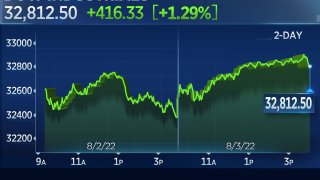

The Dow Jones Industrial Average rose 416.33 points, or 1.29%, to 32,812.50. The S&P 500 gained 1.56% to 4,155.17, hitting its highest level since June and wiping out losses from earlier in the week. The Nasdaq Composite increased 2.59% to 12,668.16, boosted by rising tech stocks.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

A surprise rebound in July services PMI helped investors shake off worries that the U.S. has already fallen into a recession, sending traders back to beaten-down tech stocks. The index released Wednesday ended three months of declines. Data on durable goods orders and manufacturing in June were also better than expected.

Comments from St. Louis Federal Reserve President James Bullard also boosted sentiment. He told CNBC Wednesday morning that he doesn't think the U.S. is currently in a recession, and that rate hikes to tame high inflation will continue.

"As the chair said, we're not in recession right now," Bullard said during a live "Squawk Box" interview. "With all the job growth in the first half of the year, it's hard to say that there was a recession."

Money Report

Earnings season continued, giving investors hope that the market can recover and potentially start a new bull market as opposed to a bear rally. The S&P 500 is up about 14% from its recent intraday low in June, and the Nasdaq is at levels not seen since May.

Traders shook off anxiety that House Speaker Nancy Pelosi's visit to Taiwan could further strain already tense U.S.-China relations. China had spent weeks warning her not to make the trip.

Lea la cobertura del mercado de hoy en español aquí.

Best trades on CNBC Wednesday: Pros share why they like PayPal after shares leapt 9%

Shares of PayPal ripped 9% higher on Wednesday, and the pros discuss why they're so keen on the payments giant. The rally came after stronger-than-anticipated quarterly earnings.

-Darla Mercado, Christina Falso

All three major averages closed higher, snapping two days of losses

All three major averages rallied Wednesday, reversing losses from earlier in the week.

The Dow Jones Industrial Average rose 416.33 points, or 1.29%, to 32,812.50. The S&P 500 gained 1.56% to 4,155.17, hitting its highest level since June. The Nasdaq Composite increased 2.59% to 12,668.16, boosted by rising tech stocks.

—Carmen Reinicke

Multiple trends point to no recession in the first half

The economy may be showing a classic recession sign, but it doesn't feel that way for the jobs market.

Multiple data points regarding employment in the first half of the year don't mesh with what usually happens during recessions, according to research that CNBC's Steve Liesman gathered.

For one, payrolls usually decline during downturns, when they actually rose in the first of the year. Personal consumption also grew at a solid pace in the first six months, in contras with historical recession trends.

Still, GDP fell 1.6% in the first quarter and 0.9% in the second quarter, meeting a common definition of a recession.

—Jeff Cox

Stocks near session highs in last hour of trading

All three major averages continued their rallies, aiming to erase losses from a two-day slide earlier in the week, as stocks started their final hour of trading Wednesday. The Nasdaq Composite led gains, up 2.69%. The S&P 500 rose 1.75% and the Dow Jones Industrial Average added 478 points, or 1.48%

—Carmen Reinicke

Disney, Apple lead Dow gains

The top stocks in the Dow Jones Industrial Average on Wednesday are two household names: Disney and Apple.

Shares of Disney rose more than 4%, making it the Dow's top performer. It was followed closely by Apple, which ticked up nearly 4% during Wednesday's session.

It appeared both stocks were lifted by positive market sentiment and an overall earnings season that has not been as bad as analysts feared. Apple reported quarterly results last week that beat expectations on profit and revenue. Disney is scheduled to report its quarter next week.

—Carmen Reinicke

Moderna, PayPal lead Nasdaq higher

A broad rally on Wall Street is being led by the Nasdaq Composite, which has jumped 2.6% today.

The top mover among major Nasdaq stocks is Moderna, which surged 16% on the back of a blowout earnings report. That move appears to be boosting other biotech stocks, with Gilead and Regeneron rising 6.1% and 5.8%, respectively.

Elsewhere, PayPal has gained more than 8% after the payments company reported strong earnings and a new information-sharing agreement with activist firm Elliott Management.

— Jesse Pound

S&P 500 now up 13% from June low as Wall Street's rebound gets back on track

The July rally for Wall Street appears to have resumed, as the S&P 500 is now up more than 13% from its recent low on June 16.

At its June low, the S&P 500 was down more than 23% from its record high, putting it firmly in bear market territory.

Now, the index is down about 13.4% from its high watermark.

The rally for stocks has also been accompanied by a rebound for bonds. The benchmark 10-year Treasury was trading near 2.77% on Wednesday, down from nearly 3.5% in mid-June.

— Jesse Pound

S&P 500 erases losses from earlier in the week

The S&P 500 rallied up 1.61% Wednesday, hitting its highest level since June. The gains also erased all losses from the average's two-day slide earlier in the week.

—Carmen Reinicke

Ford rises on solid July sales figures

Shares of Ford gained more than 3% in intraday trading Wednesday after the automaker released its July sales figures. The report showed new vehicle sales increased 36.3% on the year, where industry-wide estimates anticipated a slowdown.

—Carmen Reinicke

Oil falls on surprise U.S. supply increase, drop in gasoline demand

Crude oil futures fell 2% after government data showed an increase in crude inventories and lower demand for gasoline at the pump.

Crude stockpiles built by a surprise 4.5 million barrels last week, but analysts said that was due to the release from the Strategic Petroleum Reserve. Gasoline stockpiles grew by 160,000 barrels, while analysts had expected a decline. Consumers used just 8.5 million barrels a day of gasoline, compared to 9.4 million in the period last year.

Earlier Wednesday, oil futures were trading higher. OPEC+ agreed to increase its output target by 100,000 barrels a day, smaller than its prior increases. West Texas Intermediate crude futures were at $92.50 per barrel, off 2%. RBOB gasoline futures fell 2.4% to $2.98 per gallon.

John Kilduff of Again Capital called gasoline demand "depressed," even though prices have been falling.

Kilduff said some traders had expected OPEC plus to add more oil to the market, but OPEC leader Saudi Arabia is near capacity. "The Saudis are actually pumping at the highest level since March, 2020. Over 11 million barrels a day," Kilduff said.

—Patti Domm

Stocks near session highs at midday

All three major averages were near session highs midday Wednesday, shaking off a two-day slide.

The Dow Jones Industrial Average was up 336 points, or 1.04%. The S&P 500 gained 1.25% and the tech-heavy Nasdaq Composite increased 2.11%.

—Carmen Reinicke

Stocks could retest June lows, Evercore ISI's Julian Emanuel says

Evercore ISI's Julian Emanuel doesn't think we've seen the bottom yet in the bear market, and will once again challenge June lows, even as investors remain 'complacent' after last month's rally.

The strategist believes investors are overly optimistic, pointing to elevated options and meme stock trading, given slowing growth and troubling signs in bond yields that indicate more trouble ahead for equity markets.

"The falling yield story has likely run its course and that too, is a headwind for stocks, but the options market is telling you that people just aren't really concerned about too much," Emanuel said on CNBC's "Squawk on the Street."

"And that to us is much more typical of sort of late cycle August coming into September, which tends to be a dangerous month, type of behavior," he added.

— Sarah Min

Robinhood stock jumps after analysts say layoffs will improve profitability

Shares of Robinhood surged more than 13% Wednesday, just a day after the company announced it would lay off about 23% of its workforce. It is the second time the company has said in recent months it will trim staff - it also cut 9% of its workforce in April.

But those job cuts will help the company going forward, boosting profitability and shares, analysts argued in notes following the news.

Read more on CNBC PRO.

—Carmen Reinicke

Technicals point to June low marking the start of a new bull market, Ned Davis data shows

Chances of the June low being the start of a new bull market are increasing, data compiled by Ned Davis Research shows.

The firm noted that several breadth indicators show that the market's performance since hitting an intraday low on June 17 is more indicative of a new bull starting — rather than another bear market rally. The S&P 500 is up more than 12% in that time frame.

Check out the full story on CNBC Pro.

—Fred Imbert

Bond yields continue big move higher on hawkish Fed, better services data

Treasury yields are continuing a rapid march higher, on hawkish comments from multiple Federal Reserve officials and after stronger-than-expected data on the services sector.

The benchmark 10-year yield was at a high of 2.81%, continuing the bounce started right after it touched a low of 2.52% Tuesday morning. That yield was ended last week at 2.65%. The 2-year yield, which most closely follows Fed policy, was at 3.14%, up sharply from Friday's close of 2.89%.

"I think really the story here is markets were really embracing the idea that we're going to have an imminent recession," said Jan Nevruzi, NatWest Markets rate strategist. "That is just not showing up."

ISM Services, released at 10 a.m. ET, came in above estimates at 56.7 from 55.3 in June.

Fed officials continued their hawkish comments Wednesday, after a parade of speakers drove rates sharply higher Tuesday. St. Louis Fed President James Bullard told CNBC Wednesday that he wants rates to get to 3.75%-4.00% this year. That would be higher than the current Fed forecast for 3.25%-3.5%.

The futures market had been pricing for a Fed pause in hiking but Fed officials have made clear their work is not done and inflation is still high. Bullard also said he does not currently see a recession. Some bond strategists said they believe yields may have set a near-term low Tuesday.

—Patti Domm

Stocks hit session highs after strong ISM report

The major averages built on their earlier gains after the release of stronger-than-expected U.S. services data. The Dow Jones Industrial Average traded more than 200 points higher, or 0.8%. The S&P 500 gained 1%, and the Nasdaq Composite rallied 1.8%.

—Fred Imbert

Services data shows surprise rebound

Investors received some positive economic news on Wednesday morning.

The ISM non-manufacturing purchasing managers index showed a surprise rebound in July. The reading came in at 56.7, above 55.3 in June. Economists surveyed by Dow Jones were expecting 54.

June factory orders also came in better than expected, rising 2%. Economists surveyed by Dow Jones were expecting a gain of 1.2%.

— Jesse Pound

Meme stock mania makes a comeback?

Wild trading in an obscure Hong Kong-based fintech firm is turning heads on Wall Street and sparking conversations about meme stock mania again.

AMTD Digital saw its shares skyrocket 126% Tuesday alone after experiencing a series of trading halts. It's a subsidiary of investment holding firm AMTD Idea Group, went public in mid-July with its American depositary receipts trading on the NYSE. Two weeks later, the stock is up 21,400% to $1,679 apiece from its IPO price of $7.80.

"As we've learned over the past two years, events like this cause what I would say is opportunities for profit but great risk for loss particularly for our retail investors," Jay Clayton, former SEC chairman, said on CNBC's "Squawk Box" Wednesday.

— Yun Li

Stocks rise at market open

Stocks were higher at Wednesday's open, rebounding after two days of losses. The S&P 500 gained 0.73%, the Nasdaq Composite rose 1.19% and the Dow Jones Industrial Average increased 221.31 points, or 0.68%.

— Carmen Reinicke

OPEC+ set to increase oil production by tiny amount

OPEC and its allies on Wednesday agreed to raise oil production by a small amount, 100,000 barrels per day, in response to President Joe Biden's trip to Saudi Arabia last month. During the visit, Biden had aimed to persuade the group's leader to pump more oil to help the U.S. economy and global supply. The miniscule raise is seen as a rebuff.

— Carmen Reinicke

Starbucks shares tick up after earnings release

Shares of Starbucks gained nearly 2% in premarket trading after the coffee chain posted quarterly earnings Tuesday after the bell. The company beat expectations on earnings and revenue, boosted by U.S. demand for cold drinks even amid high inflation.

"We had actually record customer counts and record average weekly sales," during the last quarter, Rachel Ruggeri, Starbucks chief financial officer, said on CNBC's "Squawk Box."

— Carmen Reinicke

Moderna rises after beating earnings expectations

Shares of Moderna rose nearly 4% in premarket trading after the covid-19 vaccine maker posted quarterly results that beat Wall Street's expectations for both profit and revenue. In addition, the company announced $3 billion in share buybacks, and maintained its full-year outlook.

— Carmen Reinicke

Potential earnings revisions are a risk for second half, RBC's Calvasina says

This earnings season, results have generally come in higher than Wall Street's expectations, showing that companies are faring current economic conditions better than analysts hoped, RBC head of U.S. equity strategy Lori Calvasina wrote in a Wednesday note.

"The good news for the US equity market is that evidence of resilience continues to be seen in corporate earnings," Calvasina said. "The bad news for the US equity market is that the possibility of further downward earnings revisions remains a risk as we get deeper into the 2 nd half of the year."

So far, estimates for earnings and revenue in the second half of 2022 and for the full-year 2023 have come down.

Still, the strength of corporate earnings this quarter may suggest that any upcoming economic downturn will be short and shallow, according to Calvasina. That's good for stocks now, but could set them up for further volatility.

"That's been supportive of stock prices over the past few weeks, but going forward it also tells us that the rally in stocks is fragile given the possibility of further downward earnings revisions as 2023 comes into view," she said.

— Carmen Reinicke

CVS gains on earnings beat

Shares of CVS Health rose more than 3% in premarket trading after the company reported better-than-expected quarterly earnings before the opening bell. The company also lifted its earnings outlook for the year, saying health services is helping boost sales.

— Carmen Reinicke

Pelosi leaves Taiwan

House Speaker Nancy Pelosi left Taiwan on Wednesday after a visit that increased tensions with China and rattled financial markets a bit.

Pelosi met with Taiwan President Tsai Ing-wen on Wednesday. China, which considers the disputed island part of its territory, increased military drills in the Taiwan strait amid her visit. The S&P 500 is down about 1% this week as traders worried about the ramifications of Pelosi's trip for China relations. But the market was set for a bit of a relief rally on Wednesday following her departure.

—John Melloy

AMD shares fall on weak revenue guidance

Shares of AMD traded 5% lower in the premarket after the chipmaker issued third-quarter revenue guidance that was below analyst expectations.

AMD said it expects $6.7 billion in revenue for the third quarter, below a Refinitiv forecast of $6.82 billion.

The disappointing guidance overshadowed better-than-expected earnings and revenue for the second quarter.

—Fred Imbert

European markets mixed as cautious sentiment persists; Avast up 42%

European stocks were mixed on Wednesday, continuing the cautious regional trend this week.

The pan-European Stoxx 600 slipped 0.2% in early trade, with autos falling 1.5% while tech stocks gained 1.2%.

It's a busy day for earnings in Europe, with Commerzbank, SocGen, BMW, Banco BPM, Siemens Healthineers, Veolia and Wolters Kluwer among the companies reporting before the bell.

Shares of Czech cybersecurity firm Avast soared 42% after the U.K.'s competition regulator provisionally cleared its $8.6 billion sale to U.S. peer NortonLifeLock.

— Elliot Smith

Focus on data, not what Fed speakers are saying, Art Hogan says

Despite the "parade of Fed speakers," that's not what investors should focus on, according to Art Hogan, chief market strategist at B. Riley Financial.

"I think that investors have to pay more attention to what the data is telling us than what every individual Fed speaker, whether they're a voter or not, has to say about what our expectations should be," Hogan told CNBC's "Squawk Box Asia."

Still, he said Fed officials have been able to shift expectations for where Fed policy is heading.

St. Louis Federal Reserve President James Bullard on Tuesday said the central bank will need to keep hiking rates, and the Fed funds rate likely will have to go to 3.75%-4% by the end of 2022. San Francisco Fed President Mary Daly said "our work is far from done" in fighting inflation, while Chicago Fed President Charles Evans said another large rate hike is possible, though he hopes it can be avoided.

After last week's meeting, some expected the Fed would continue hiking to reach 3.25%-3.5% before pivoting in 2023, Hogan said.

"I think the parade of Fed speakers this week has done a pretty good job of pulling that back, tamping down those expectations," he said.

— Abigail Ng

These stocks are poised for a comeback if inflation peaks, Jefferies says

A slowdown could be on the horizon, and more earnings downgrades ahead have been predicted. If inflation also peaks, as some analysts expect it to, that mix of factors will favor one class of stocks, Jefferies says.

Jefferies produced a screen of such stocks that investors can buy, based on a list of metrics which include high profitability, reasonable valuations and good cashflows. Pro subscribers can read the story here.

— Weizhen Tan

PayPal rises on earnings, share buyback announcement

PayPal shares soared by more than 11% after hours. The payments company beat analysts' earnings and revenue estimates for the second quarter and issued upbeat full-year guidance. PayPal also announced a $15 billion share repurchasing program.

Stock buybacks provide a way for companies to boost their per-share earnings and enhance the value of their stock, particularly while the market across the board suffers steep price declines this year. The company kicked off a $10 billion program four years ago.

Elliott Management said it has a $2 billion stake in the payments giant. PayPal announced that it entered an information-sharing agreement on value creation with the activist investor.

— Tanaya Macheel

Despite Fedspeak about fighting inflation, an ‘easing cycle’ is emerging says Leuthold’s Jim Paulsen

Leuthold Group chief investment strategist Jim Paulsen said that despite the Federal Reserve's "ongoing lip service toward fighting inflation" by tightening monetary policy, there are several factors that suggest the market may be entering an "emerging easing cycle."

Bond yields have achieved a sizable rate cut, the dollar is finally rolling over and junk spreads have pulled back, he said in a note to investors late Tuesday.

"The media, policy officials, and investors focus primarily on the war against inflation and how aggressively the Fed will need to keep hiking rates," Paulsen said. "Yet, with real economic growth already reduced to a crawl and evidence building that inflation is easing, the case for further Fed tightening at its September meeting is rapidly falling apart."

"Investors should place appropriate weight on the leading nature of economic policies," he added. "Tightening today means lower real and nominal growth tomorrow."

— Tanaya Macheel

MatchGroup shares tumble after hours

Shares of the dating app operator Match Group tumbled as much as 23% after the company reported revenue of $795 million for the second quarter, compared with FactSet estimates of $803.9 million. Match also issued weak guidance around adjusted operating income and revenue for the current quarter.

— Tanaya Macheel