About 26 million Americans have lost their jobs within the last month amid the ongoing coronavirus pandemic.

Another roughly 4.4 million Americans filed for unemployment benefits for the first time last week. That's on top of the nearly 22 million who have already applied since the pandemic started to hit the U.S. And millions more are expected to file before the country reopens.

The good news: The federal government is allowing states to expand eligibility for unemployment benefits because of the impact of COVID-19. If your employer had to temporarily shut down operations because of coronavirus, you can file. The same is true of employees who are currently being quarantined but expect to return to work after.

Congress also recently enacted a $2 trillion relief package, which boosts unemployment benefits by expanding who is eligible, extending the time period you're able to claim state unemployment benefits by an additional 13 weeks on top of your state's maximum, and upping unemployment benefits by an extra $600 per week for up to four months.

"In this emergency, I would not discourage anyone from trying to apply for benefits, even if they wouldn't have applied before," Michele Evermore, senior policy analyst for the National Employment Law Project, tells CNBC Make It.

Last year, the national average unemployment benefit replaced about 45% of a worker's pay, according to data from the Department of Labor. Typically, the payments can last up to 26 weeks, although, in the past, states have opted to extend benefits when unemployment rates have been high.

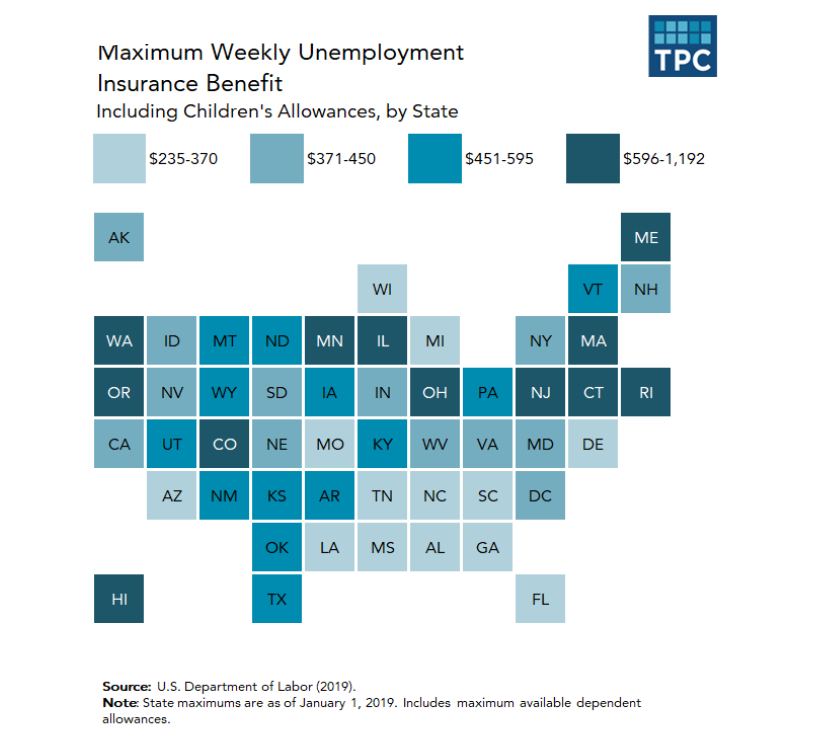

But who gets benefits and how much they receive does vary dramatically by state, Evermore says. Florida, for example, approves just one in 10 of those filing for unemployment, while in North Dakota about 65% of the unemployed receive benefits, according to recent research from the Tax Policy Center.

Money Report

If you find yourself needing to file for unemployment, here are five steps to navigate the process as smoothly as possible.

1. Have your information ready to file

Even if you haven't been laid off or had a dramatic reduction in your hours, now is the time to make sure you have copies of your most recent pay stubs, Evermore says. Make sure those are easily accessible (either printed out or saved on your computer) because if the employer shuts down, it may be more difficult to get copies.

When filling out your application for unemployment benefits in the state where you worked, the employment agency will need to verify your income. If the employer is no longer in business, you're going to need your own records, Evermore says.

It's also important to document any communications from your manager or employer about your work situation. That can mean anything from emails from your boss about reducing your hours to taking photos of "closed" notices hung in store windows.

Many states have a "waiting period," usually about a week, that you have to undergo before you can receive your unemployment benefits. However, states like Kentucky, New York, Pennsylvania, Virginia and Wisconsin are waiving mandatory waiting periods so workers can get benefits faster. With that in mind, it's best to file as soon as you have news that your job status has changed.

In addition to documentation verifying your income and work status, you'll also typically need to have the following details on hand:

- Social Security number

- Home address and mailing address (if different)

- Telephone number

- Email address

- Your bank name, address, account number and routing number for direct deposit

- Employer's name, address and phone number

- First and last day worked with employer

- Reason for leaving

- Pension or severance package information (if applicable)

2. File online as soon as you can if possible

The good news, particularly for tech-savvy millennials, is that states are really trying to move as much processing online as possible, and that's been happening for a while. In most states, online applications are strongly encouraged, Evermore says.

The Department of Labor's CareerOneStop site has a helpful tool where you can look up each state's direct unemployment website and contact information.

Yet because of the influx of people applying as a result of the coronavirus pandemic, several states are having trouble with their unemployment sites crashing.

"That's totally to be expected right now in this completely unprecedented period where all of a sudden, everyone is unemployed on the same day," Evermore says. But keep trying, she says.

In cases where you can't get through online, you can also call. Keep in mind that in many states, whether you call or go online, you can only start an application during normal business hours. Hawaii, for example, restricts online applications to between the hours of 6:30 a.m. to 11:00 p.m. HST, Monday through Friday, and between 9:00 a.m. to 11:00 p.m. HST on weekends and holidays. "It's better to try to apply between 9 a.m. and 5 p.m.," Evermore says.

Because it may take longer to get benefits than normal due to the sheer influx of people applying, Evermore recommends applying as early as you can. Typically, it takes about two to three weeks after you file your claim to receive your first benefit check if you're approved. But there is probably going to be a bottleneck when it comes to getting everything, including approvals, processed, Evermore says.

From the academic research "Rethinking Unemployment Insurance Taxes and Benefits," by Ryan Nunn and David Ratner of the Tax Policy Center.

3. Apply even if you're not sure you're eligible

The process to file for unemployment varies by state, but there are two key questions you'll need to answer: Did you lose your job through no fault of your own? Are you able and available for work?

If you can answer yes to those questions, you're more likely to get benefits. "Err on the side of applying if you're not sure — a lot of people are eligible that may not realize it," Evermore says. The No. 1 reason why people don't apply is because they don't think they're eligible, but with states expanding eligibility, anyone who's recently lost their job should at least fill out an application.

You also don't have to lose your job to receive unemployment. You can actually receive partial unemployment if your hours have been drastically reduced or if you're unable to work because you've been put into mandatory quarantine during the coronavirus outbreak. However, if you are sick, you're likely not eligible for unemployment benefits because you're not able to work.

And under Congress' relief package, many so-called "gig workers" can qualify for unemployment benefits through the Pandemic Unemployment Assistance program. Self-employed workers — including independent contractors, freelancers, workers seeking part-time work and those who do not have a long enough work history to qualify for state unemployment benefits — who live in states that make an agreement with the Department of Labor will receive Pandemic Unemployment Assistance based on their recent earnings and will also be able to receive $600 a week.

The Pandemic Unemployment Assistance will run through the end of 2020 and workers will be eligible for retroactive benefits dating back to Jan. 27 and can access benefits for up to 39 weeks.

The National Employment Law Project recommends that gig workers first apply for regular unemployment because many states have a broad definition of employment. Keep in mind that workers are not eligible for the new pandemic assistance if they can apply for regular unemployment, can telework with pay, are receiving paid sick days or paid leave or are undocumented workers.

4. Be prepared to wait

"States have been paring back their unemployment insurance systems since the last recession," Evermore says. There are concerns about states being able to handle the workload and many Americans have complained about the long wait times and sites crashing.

State administrative funding is based on what the unemployment rate was last year, which was very low. "States are underfunded — they're not staffed up very well right now," Evermore says. There is legislation pending before the Senate that would provide some emergency relief funding for state agencies, but that may not be enough.

5. If you're denied, appeal

After you file your claim, your state agency will typically review the information you provide, talk to your past employer, and may even call to interview you about your situation. Most states also require employees to have worked a certain amount of time and/or earned a minimum amount to be eligible for benefits.

If the agency believes you don't meet any of its requirements, it can deny your claim for benefits. But don't give up, Evermore says.

"Most people don't realize that if you're denied benefits on the first try, you can always try to appeal," Evermore says. That process can be a bit time-consuming, but it's worth it. And with the COVID-19 situation continuing to evolve, your eligibility may change.

"If you get rejected, appeal," she says.

Check out: The best credit cards of 2021 could earn you over $1,000 in 5 years