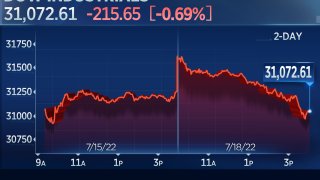

A stock rally on Wall Street lost steam on Monday, with the Dow Jones Industrial Average losing a more than 350 point gain from earlier in the session.

The Dow Jones Industrial Average lost 215.65 points, or 0.69%, to 31,072.61 — accelerating losses in the final hour of trading and erasing a 356 point jump earlier in the day. The S&P 500 fell 0.84% to 3,830.85. The Nasdaq Composite declined 0.81% to 11,360.05

The late-day pullback follows a Bloomberg report that said Apple plans to slow hiring and spending on growth next year to deal with a possible downturn. Shares of Apple declined nearly 2.1%.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

"When Apple, a $2.4 trillion dollar company market cap-wise, rolls over, it's obviously going to have a pronounced impact on the headline indices and it just reminds people that companies are buckling down because of what they're seeing out there," said Peter Boockvar, chief investment officer at Bleakley Advisory Group.

Boockvar said Apple earnings will be important to the overall market in terms of how they manage currency, what's happening in the Chinese business and how they're going to react as consumers move more toward services rather than goods spending.

"People are not going to keep buying laptops every year, and they're not going to replace their phone every year," Boockvar added.

Money Report

A strong earnings report from Goldman Sachs initially buoyed stocks, following mixed results last week from banks JPMorgan Chase and Morgan Stanley, though some on Wall Street warned investors to err on the side of caution during what's expected to be a choppy earnings season.

"We anticipate volatility to remain elevated as the market toggles between pricing recession risk and soft landing probabilities with each piece of data," Citi's Scott Chronert said in a recent note.

On Monday, Goldman Sachs posted earnings and revenue that easily beat expectations, even as CEO David Solomon said during an earnings call that inflation is "deeply entrenched" in the economy. Shares popped 5.6% at one point before easing and ending the day with a 2.5% gain.

Strong results from its fixed income operations helped Goldman Sachs offset a drop in investment banking revenue. Bond traders at the bank generated about $700 million more revenue than expected following increased trading in interest rates, commodities and currencies.

Bank of America reported quarterly revenue that beat analyst expectations, with shares ticking slightly higher. IBM will post results after the closing bell.

Other major companies set to report earnings this week include Johnson & Johnson, Netflix, Lockheed Martin, Tesla, United Airlines, Union Pacific and Verizon.

Earnings expectations

Despite the growing recession fears, S&P 500 companies are expected to post a 4.2% year-over-year increase in second-quarter profit, according to consensus analyst estimates gathered by FactSet. S&P 500 revenues are seen expanding 10.2% in the quarters, according to FactSet.

Profit expectations for the full year are still high with analysts estimating S&P 500 companies will lift 2022 earnings by 9.9%, data collected by FactSet show.

"We expect the results to be generally okay," said Terry Sandven, chief equity strategist at U.S. Bank Wealth Management. "Focus will primarily be on margins and to the extent to which companies are able to pass along higher input costs, that'll dictate where perhaps valuations can go."

Energy stocks gained in the broader market index. Shares of Hess jumped 4.8%. Devon Energy gained 3.6%, and Marathon Oil climbed nearly 3.5%.

Meanwhile, Boeing shares dipped slightly on news that Delta Air Lines was buying 100 737 Max 10 planes. Shares of Delta jumped about 3.5%.

Less aggressive Fed?

Investors assessed the likelihood that the Fed will be less aggressive than feared at its meeting later this month. A Wall Street Journal report Sunday said the central bank is on track to lift interest rates by 75 basis points, instead of the full percentage point increase forecast by some market participants.

Goldman Sachs chief economist Jan Hatzius also said in an overnight note that he expected the Fed to raise rates by three quarters of a point.

Still, recession fears have been prominent in recent weeks as Wall Street considered decades-high inflation, sharply rising interest rates and an inverted yield curve signal.

"Markets are likely to remain volatile in the coming months and trade based on hopes and fears about economic growth and inflation," Mark Haefele, chief investment officer at UBS Global Wealth Management, said in a recent note to clients.

"A more durable improvement in market sentiment is unlikely until there is a consistent decline both in headline and in core inflation readings to reassure investors that the threat of entrenched price rises is passing," he added.

— CNBC's Patti Domm contributed to this report.