- Research firm New Constructs has put particularly pessimistic calls on some of this year's hottest IPOs.

- The firm said electric vehicle Rivian was worth $13 billion at the time of its IPO last month, about one-fifth of its initial market cap.

- "I feel really good when we put something out there that just makes a lot of mathematical sense," said New Constructs CEO David Trainer.

Just before Sweetgreen held its IPO last month, research firm New Constructs came out with a particularly gloomy price target on the salad restaurant chain: $0. The offer price was $28.

A week earlier, New Constructs said Rivian was worth $13 billion, far shy of the $66.5 billion valuation it achieved on IPO day. Before GitLab hit the market in October, the firm valued the code-sharing software developer at as low as $770 million, or 93% below where the company sold shares.

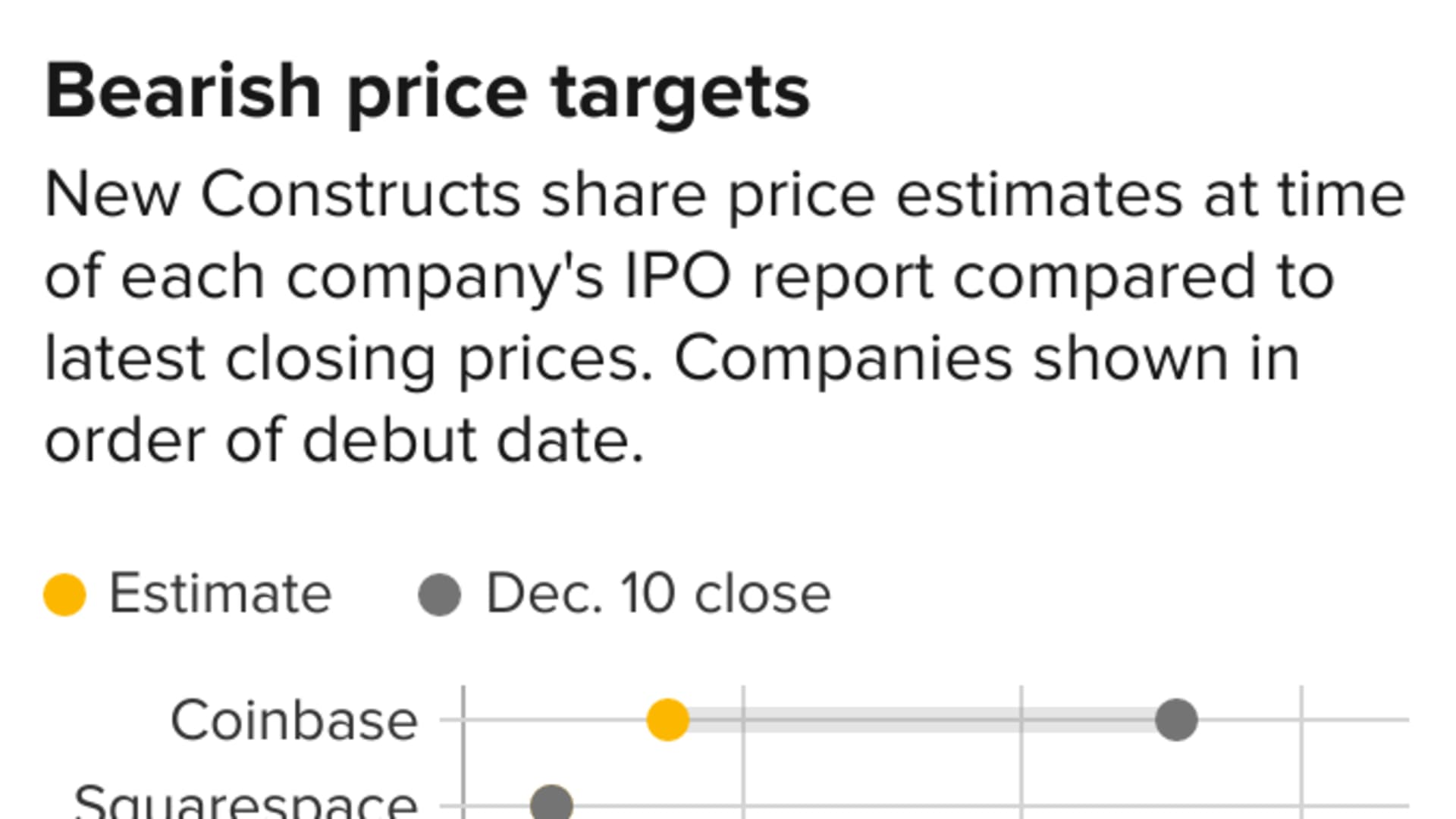

None of those calls have come close to hitting the mark. Even after a recent sell-off that pushed almost all of this year's IPOs into bear market territory, New Constructs' bearishness looks extreme.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

David Trainer, founder and CEO of the 19-year-old firm and a former Wall Street analyst, isn't deterred.

"I feel really good when we put something out there that just makes a lot of mathematical sense," said Trainer, 49, in a recent interview over video. "Crazy stuff happens. I can't let that bother me. I have to stay true to what I think is right."

Trainer does not think IPO valuations are anywhere close to right.

Money Report

His research is based on a model he's refined over the past two decades to evaluate company fundamentals, like cash flow, earnings, and competitive moat. It serves as an antidote to the hype cycle that's shoved venture-backed start-ups into the public market with big promises instead of profits.

IPOs are poised to end the year with a record level of fundraising, surpassing the previous record set in 2020. On Thursday, infrastructure software vendor HashiCorp debuted on the Nasdaq and closed the day with a market cap of over $15 billion, becoming the 19th tech company to go public this year with a valuation that's currently above $10 billion.

This week, Samsara, whose technology connects devices to the internet, is poised to be the 20th.

Both companies are losing money.

Trainer knows that his downbeat views on tech IPOs put him on a financial island. That resembles his location in real life.

Some 900 miles from Wall Street, Trainer lives and works in Nashville, Tennessee, where he and his wife both grew up and have three kids.

"We have a different belief system than Wall Street," said Trainer, whose firm has about 20 employees. He avoids recruiting people with traditional finance experience because they tend to be "brainwashed to be a Wall Street banker and to do research like what we've seen in the past," he said. "What we do is counter to that."

Trainer started New Constructs in 2002 after six years as an analyst, primarily at the firm known then as Credit Suisse First Boston. After having a front-row seat to the dot-com boom and bust and seeing the troubling role analysts played in hyping companies that also happened to be banking clients, Trainer wanted to create a firm that focused exclusively on research, removing it from any potential conflicts.

His company relies on software to sift through thousands of pages of quarterly reports, annual filings and prospectuses and make determinations on how companies should be valued. By letting computers do the quantitative work, New Constructs is able to cover more than 10,000 stocks.

Little competition on IPO coverage

Trainer said the firm has hundreds of customers in the investment universe, including partnerships with TD Ameritrade and Interactive Brokers. Both firms make New Constructs' reports available to any customer with a brokerage account.

IPO coverage is just a piece of the mix. Trainer's team has lists like "most attractive stocks" and "most dangerous stocks" and it rates exchange-traded funds in various sectors.

It also goes deep on public companies. In a November report, New Constructs said Tesla's $1.2 trillion valuation implies the company "owns 60%+ of the entire global passenger EV market and becomes more profitable than Apple (AAPL) by 2030," even as its EV market share is declining.

In July, the firm said that for Uber to justify its valuation, the company would have to control 171% of the total addressable market for ridesharing and food delivery in 2030.

But Trainer's IPO reports include the most provocative calls and have helped New Constructs stand out in a market that's saturated with coverage of big public companies.

"We don't have as much competition in the IPO space," Trainer said. "If we are quick when the S-1 comes, we can be one of the first companies to have an opinion out there."

That's because traditional sell-side firms don't cover IPOs. Investment banks are restricted from publishing material during a quiet period after the offering, and companies don't typically start providing forecasts until they first report earnings.

New Constructs can play by different rules. The firm doesn't do advisory work and is using publicly available information from prospectuses, roadshows and other online material to form its position.

Because it's solely a research firm, readers know there's no ulterior motive, Trainer says, unlike investment banks that are covering the same companies they're courting as clients.

"The higher the capital-raising needs, the fewer bearish people you're going to see," Trainer said, referring to the swarm of coverage that bigger companies attract in the months after they go public. "Set your watch to it."

Trainer jumped into the IPO game in 2015, just after cloud software vendor Box made its New York Stock Exchange debut. The inaugural report on Box was titled, "This IPO belongs back in the tech bubble," and said that to justify its $22 share price after the pop, the company would need to increase its pre-tax margin to 10% from -127% while growing revenue 20% for 25 years.

Box hasn't been a good investment relative to the broader market, but it hasn't crashed either, and currently trades around $25.

New Constructs dabbled in other IPOs over the next couple years, putting out "danger zone" warnings on travel site Trivago in late 2016 and Snap in early 2017, highlighting the social media company's "dismal fundamentals and nosebleed valuation."

The Trivago call looks smart, as the stock has plummeted to $2.19 from its $11 offer price. Snap, on the other hand, has more than tripled in value since its IPO.

Trainer's IPO coverage became more frequent in 2018, with reports reports on software makers Dropbox, Domo, Avalara and Eventbrite along with non-tech companies like BJ's Wholesale Club and thermos and cooler maker Yeti.

But New Constructs' critical eye really paid off in 2019.

"WeWork is the most ridiculous IPO of 2019," read the headline of a New Constructs report on Aug. 19, five days after the office-sharing company, valued privately at $47 billion, filed its initial prospectus.

"WeWork has copied an old business model, i.e. office leasing, slapped some tech lingo on it, and suckered venture capital investors into valuing the firm at more than 10x its nearest competitor," New Constructs wrote.

Six weeks after the firm placed WeWork firmly in the "danger zone," the company pulled its IPO. Investors balked at the company's valuation and were turned off by mounting losses, shoddy corporte governance and a torrent of devastating news on founder and then-CEO Adam Neumann.

"That was a bit of a gamechanger for us," Trainer told CNBC. "That IPO never even happened and a lot of people gave us credit for changing the course of events there."

In a victory lap of sorts, New Constructs published a follow-up report titled "WeWork’s Failed IPO Is a Win for Main Street."

But WeWork has been an exception. More typically, stocks have rocketed up after their IPOs as retail investors celebrate their first opportunity to get in on the party.

In November 2020, for example, New Constructs applied its WeWork model to DoorDash, the food delivery company whose business more than tripled in size during the pandemic.

"This IPO reminds us of WeWork's attempted IPO, which we called The Most Ridiculous IPO of 2019, because DoorDash's business is similarly disadvantaged," New Constructs wrote in a note headlined "The Most Ridiculous IPO of 2020."

The report said DoorDash had no profits on the horizon and faces "competition that can offer the same service for free." New Constructs thought DoorDash was crazy at a $25 billion valuation.

Nevertheless, the company shot up on its first day of trading to over $60 billion, and is now worth around $54 billion.

'Stock is likely worth $0'

This year, New Constructs started its IPO coverage with dating site Bumble, which was "priced for perfection," and continued into November with the most pessimistic call of the year on Sweetgreen.

"We think the stock is likely worth $0 given the company's limited differentiation and the intense competition from other new entrants and established restaurants, which are easily replicating Sweetgreen's menu and concept," the firm wrote.

Sweetgreen reported a loss of $87 million in the first three quarters of the year and New Constructs saw a "narrow" path to profitability.

"Sweetgreen is an easy one," Trainer told CNBC. "It's in the business of selling lettuce. There's not a lot of complexity there and you've got a lot of good comps."

Trainer also published particularly bearish reports on shoemaker Allbirds (rated "unattractive"), eyeglasses company Warby Parker ("very unattractive"), investing app Robinhood ("unattractive" and "a casino for users, a bad bet for investors") and blogging service Squarespace ("very unattractive" with a valuation that's "out of this world").

New Constructs warned against buying GitLab because of limited cash, high burn and hefty competition from Microsoft, and said to avoid Rivian, which hasn't "shown it can consistently produce more than a handful of cars."

Those stocks haven't yet gone his way, but Trainer made one extremely prescient call this year. In June, New Constructs said Chinese ride-hailing company Didi was worth no more than $37 billion. After its NYSE debut, the market cap was almost $68 billion.

As of Friday, Didi is worth about $31 billion following a five-month slide. Earlier this month, Didi said it was delisting from the NYSE and will plan to list in Hong Kong amid pressure from the Chinese government to keep greater control over local technology.

New Constructs didn't specify delisting concerns in its report, but it did highlight regulatory issues as a major overhang. The company was reportedly already under investigation by the Chinese government on antitrust issues.

"For Didi, Chinese regulatory risk looms large," New Constructs wrote. "Chinese regulators have recently broken up and issued record fines against other large Chinese firms."

On June 30, Didi's listing day, Trainer told CNBC's "Power Lunch" that the company is "one of the many overpriced IPOs coming to market," and it wanted to "make hay while the sun shines."

Looking at the broader tech IPO market, Trainer acknowledges that the sun has been shining for a surprisingly long time. He said he expects "some sort of reckoning" eventually.

In the meantime, Trainer said he'll keep doing what he thinks is right.

"Either we believe in what we believe in or we're just swimming upstream for no reason," Trainer said. "We're not here to do people harm. We believe what we're doing is providing society a service."