This story is part of CNBC Make It's Millennial Money series, which profiles people around the world and details how they earn, spend and save their money.

For Ashley Chorath and Andrew Tiu, things have changed significantly since the beginning of the year. As doctors — Tiu is a resident physician in internal medicine and Chorath is a resident physician in radiology — the couple has been on the front line of the pandemic and seen first-hand the toll it takes on both patients and health-care workers.

They've also cut their expenses dramatically, gotten engaged and are now preparing for Chorath to move to Washington, D.C. this summer to start a new residency in psychiatry. At the same time, they're working long hours to develop their careers while struggling to pay off six figure student loan debt on relatively low salaries.

Chorath, 27, currently earns $60,000 a year, while Tiu, 31, earns $58,000. Chorath also has nearly $180,000 in student loans left to pay off.

Although the couple live a full life together in Philadelphia, where they like to try new restaurants and explore the city by bike, money is always top of mind. But it's also a topic that unites them, as they learned early on in their relationship that their financial values are closely aligned.

After completing her first year of residency in Florida, where she grew up, Chorath accepted a position in Philadelphia. In her excitement about the move, she changed her location from Florida to Philly on the dating app Coffee Meets Bagel in May 2019, and she soon matched with Tiu.

They immediately clicked and paragraphs-long text conversations turned into talking on the phone for hours since they couldn't meet in person. The pair discovered that they have a lot in common, even outside of their profession, from the cultures they grew up in to their shared faith to their penchant for saving money.

Money Report

By the time Chorath arrived in Philly that June, they knew they wanted to be together. "We ended up meeting the day after I moved to Philadelphia ... and since then we've been inseparable," Chorath says. Tiu proposed on Chorath's 27th birthday in June 2020, and they hope to get married in 2021, pandemic willing.

How much doctors earn just starting out

One of the biggest misconceptions about becoming a doctor is that you earn a high salary right out of medical school, Chorath says. For most med school grads, that's not the case. Residents earn an average of about $62,000 a year, according to career site Glassdoor.

When out to dinner with family, they'll joke that Chorath should pick up the tab because she's a doctor. "I'm like, Do you know my net worth? It's very negative," she says.

It's not cheap to become a doctor either. In addition to earning an undergraduate degree, you spend four years in medical school, followed by about three to seven years as a resident, during which you train under the supervision of attending physicians. Even though you're officially an M.D., residents earn relatively low wages, Chorath explains. It takes even longer to get your career going if you decide to do a fellowship following residency, which is a period of continued training in a specific specialty.

You don't start earning a six-figure doctor's salary until up to seven years into your career, Chorath says.

After medical school, residents are "paying $200,000, $300,000 and $400,000 of student debt back on this $50,000 or $60,000 dollar salary," Chorath says. "In addition to that, you're working many hours, usually at least 50 to 60."

"In your 20s, it's a lot of delayed gratification," Chorath says. Although she was aware of the sacrifice it would take to pursue a career as a doctor, "when you're in the brunt of it, it's a lot harder to see your high school and college classmates driving BMWs and buying houses when you're still making $55,000, working 70 hours a week and have $300,000 in debt."

But the struggle and cost of becoming a doctor is worth it for Chorath and Tiu.

Growing up in the Philippines, Tiu's dad drove an ambulance for free, taking patients to the nearest hospital two hours away, which inspired him to become a nurse. But after realizing "there's so much more that a doctor can do," he decided to go back to school to become a doctor instead.

Chorath's parents immigrated to the U.S. from South India in 1986 and instilled in her the importance of hard work. Though they're both now retired, her father was a physical therapist and her mother was a pharmacist. Similar to Tiu, she chose to become a doctor in order to help people.

"One of the greatest things about being in the medical field in general is that your objective is always a benevolent one," she says. "You're always there to help the patient and help people get better. You're usually not there to make a lot of money or for prestige."

"The greatest feeling of all is when a patient says thank you," Tiu adds.

The cost of becoming a doctor

Although taking out loans was necessary for Chorath to attend medical school, the debt weighs on her heavily. "I feel like I'm at the bottom of the hole, and I'm trying to dig my way out," she says. In med school, she worked four jobs to cover her expenses so she wouldn't have to take out more private loans than she already had.

Chorath's situation is not uncommon: The average 2019 med school grad holds an average of around $200,000 in student loan debt, according to data from the Association of American Medical Colleges.

"Right now, I'm on REPAYE, which is an income-based loan repayment program, and I plan on doing public service loan forgiveness," Chorath says, since her current hospital is not-for-profit.

With the federal government suspending payments and interest on student loans because of the pandemic, Chorath isn't contributing anything toward her debt right now. She'd rather save the money, since she plans to have her loans forgiven before they're fully paid off. Before that, she put $113 toward it per month, the minimum amount possible.

It will be a long time before Chorath is debt-free and in the meantime, she thinks about her loans "constantly."

Tiu attended medical school in the Philippines, where he earned a full scholarship for being at the top of his class, so he doesn't have any student loan debt of his own. Earning a scholarship was crucial to Tiu. When his father died in 2009, his older brother became the primary income earner for their family and planned to pay Tiu's way through med school in addition to supporting their mother.

That's custom in the Philippines, Tiu explains. Family members always step up to help each other pay for education. Tiu is grateful for his brother's help, but he didn't want to be more of a financial burden than he needed to be, so he sought out scholarships to cover his tuition costs.

Working through a pandemic

Tiu has been working directly with patients affected by coronavirus. "We had to establish a new normal in terms of protecting our patients and health-care providers," he says.

When the virus first hit, things were "really difficult with our patient care," Tiu says. Because it wasn't safe to allow family members to be near Covid-19 patients, the doctors had to not only take care of their patients, but make sure family members were getting the information they needed.

Tiu and his colleagues were scared. "Our senses really went up," he says. "Multiple patients were just coming in left and right." Tiu came down with coronavirus at the end of April, but he has since made a full recovery. He got tested when he started feeling feverish, achy and extremely fatigued.

"At the time, I was very anxious about what was going to happen to me," he says. "What am I going to tell my family? How am I going to tell my mom?"

Tiu knew firsthand how devastating the disease could be, but luckily he only had a mild case. He took two full weeks off to recover and work from home, where he was able to take virtual calls with patients.

How they budget

Chorath and Tiu aim to keep their daily expenses as low as possible in order to save for the future, make travel a priority and pay off debt. "I live as if I'm broke," Chorath says. She takes after her mother, who she says clips coupons and is always on the lookout for a good deal.

When the coronavirus pandemic closed down large swaths of the economy, it became easier than ever for the couple to save. They cut out restaurant spending, which previously cost them around $200 a month, and significantly reduced their travel expenses. Chorath also started cutting Tiu's hair, which she plans to continue doing. "That would save me $300 to $400 a year," Tiu says.

Chorath and Tiu are both Catholic and come from conservative backgrounds, so they don't live together. But because they spend so much time together, they share several of their expenses, including food and entertainment.

Here's a look at Chorath's monthly expenses as of June 2020:

- Savings: $1,700 (She isn't currently contributing to her employer's retirement savings plan, but she maxed out her Roth IRA in 2019 and plans to do the same in 2020.)

- Rent: $800 (She splits the rent on a two-bedroom apartment evenly with one roommate.)

- Travel: $100 (The couple usually takes trips about once a month, but since the pandemic started, they've only left Philly once, to visit Chorath's parents in Florida.)

- Groceries: $91 (Tiu covers the bulk of their food expenses.)

- Insurance: $65 (This covers health, dental and vision.)

- Utilities: $50 (This covers Wi-Fi and electricity.)

Chorath lives walking distance from work and is on her parents' phone plan, which allows her to save on transportation and her phone.

Before the pandemic, she spent more on clothing, Lyft rides and dining out. But with everything shut down, she's been able to cut out nearly all of her discretionary expenses and put that money into savings instead.

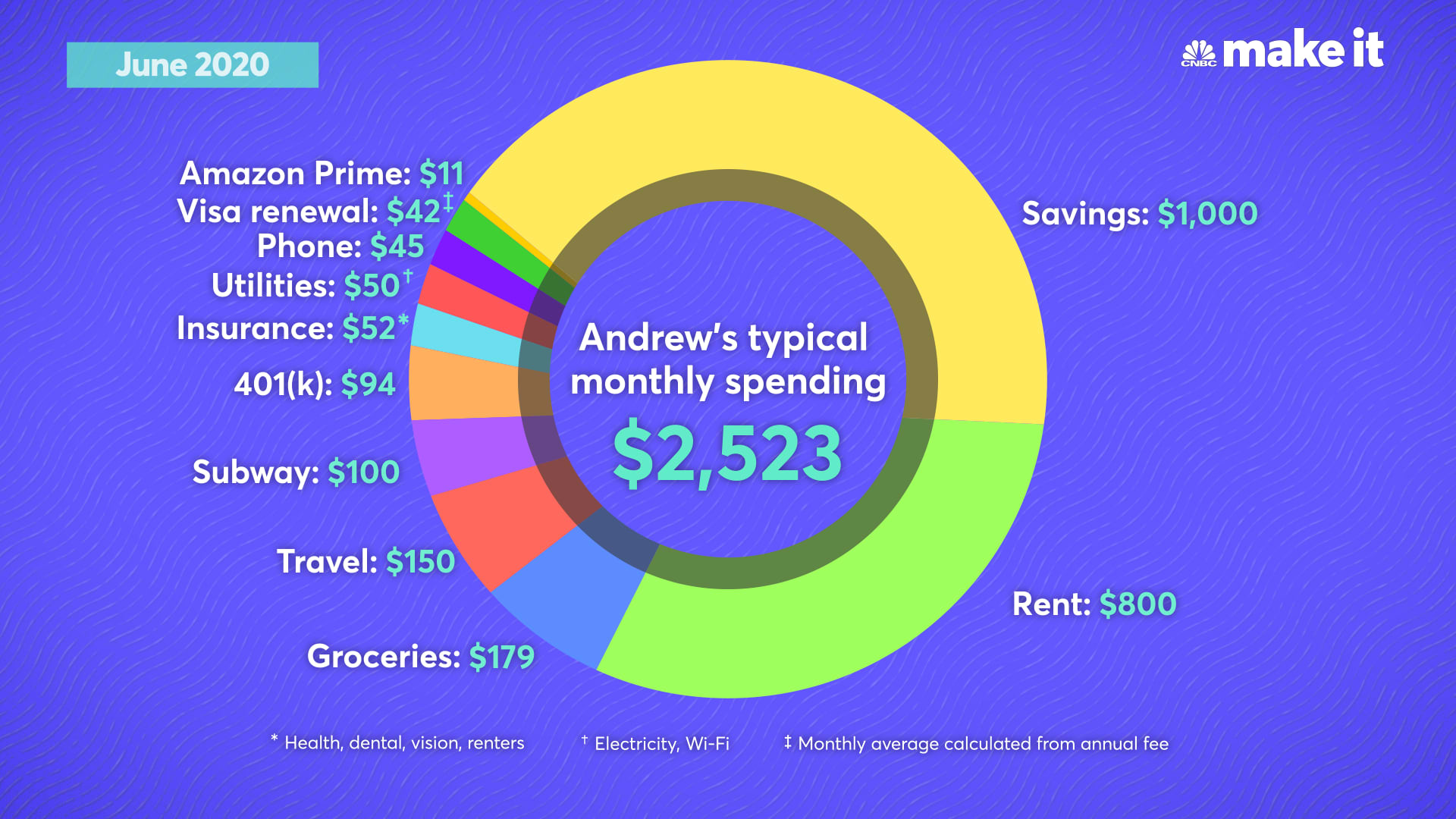

Here's a look at Tiu's monthly expenses as of June 2020:

- Savings: $1,000

- Rent: $800 (He splits the rent on a two-bedroom apartment evenly with one roommate.)

- Groceries: $179

- Travel: $150 (Tiu's portion of the Florida trip.)

- Subway: $100

- 401(k): $94 (Tiu puts 3% of his salary into his 401(k) and his job matches another 3%. He also maxed out his Roth IRA in 2019 and plans to do the same in 2020.)

- Insurance: $52 (This covers health, dental, vision and renters.)

- Utilities: $50 (This covers Wi-Fi and electricity.)

- Phone: $45

- Visa renewal: $42 (It costs Tiu about $500 per year to renew his J-1 visa.)

- Amazon Prime: $11

The couple prides themselves on being savvy about food shopping. Ask Tiu the cost of chicken, and he can list the per ounce price at every grocery store in his neighborhood. Chorath can tell you exactly where to go to get the best deal on ice cream.

In addition to diligently comparing prices and looking for deals when grocery shopping, the couple takes advantage of promotions at restaurants around the city, including discounts for health-care workers and birthday freebies. "I feel like food tastes better when it's free," Chorath jokes.

Looking to the future

Changes are on the horizon for Chorath and Tiu. Chorath is preparing for her move to the new residency program in psychiatry in DC. Although she enjoys radiology, she wants to pursue a career that gives her more face time with patients. "I feel more fulfilled when I'm working with people," she says.

The couple are also busy planning a wedding for around 180 guests. "For an Indian wedding, it's actually on the smaller side," Chorath says. "But I think it will be really fun."

They plan to spend around $50,000 of their own money, plus they'll get some additional help from Chorath's parents. "Because of my South Indian background, we actually are planning to do two events," Chorath says. Friday night, they'll host mylanchi, a traditional henna ceremony that celebrates the bride. The next day, they'll do a church ceremony and reception.

They aren't saving specifically for the wedding. "We don't really budget," Chorath says. "We just try to live as cheap as possible. That's just our personalities in general."

The couple also plans to make paying off Chorath's student loans a priority so they can live debt-free. She hopes to continue finding jobs that qualify for federal loan forgiveness, but if not, "we're just trying to attack the loans as soon as possible," she says. "We would throw both of our salaries into it."

What's your budget breakdown? Share your story with us for a chance to be featured in a future installment.

Check out: The best credit cards of 2021 could earn you over $1,000 in 5 years