This story is part of CNBC Make It's Millennial Money series, which profiles people around the world and details how they earn, spend and save their money.

Shan Shan Fu can pinpoint the exact moment she was inspired to become an entrepreneur.

It was March 2020, and the Covid-19 pandemic was quickly spreading across the U.S. Fu, 33, remembers watching a news segment that showed a long line of people waiting outside a food pantry, while the anchor detailed how Americans were getting laid off in droves.

As she watched, the San Francisco resident realized that doing nothing didn't feel OK anymore. So she decided to start a side hustle. Her idea: sell quality face masks. "When the surgeon general said everybody should wear face masks, none of my friends had good face masks," Fu tells CNBC Make It.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

She launched Millennials in Motion in April 2020, working on the business at night and on the weekends while maintaining her full-time job at a consulting firm during the day.

"I would work 9 a.m. to 5 p.m. at the consulting firm and 5 p.m. to 1 a.m. [on my side hustle]," she says. "For the first few months, there was no time off. I worked seven days a week, every waking minute."

After six months, in October 2020, Millennials in Motion's income was close to what she earned at the consulting firm, so Fu decided to focus on it full-time. Overall in 2020, Fu earned $115,000 from her consulting job and her business brought in another $111,000, for a total of $226,000.

Money Report

Growing her business

One of Fu's favorite quotes comes from Margaret Mitchell's "Gone With the Wind." "When a civilization is growing, you make slow money, but when a civilization is crashing, you make fast money," Fu paraphrases.

Although the onset of a global pandemic was a risky time to start a new business, Fu saw an opportunity to help people while capitalizing on a burgeoning industry. She knew she could make "fast money," while also helping others. Millennials in Motion donates a portion of its proceeds to Feeding America.

Fu had no prior experience in ecommerce when she decided to launch her business, so she turned to YouTube. "I swear I learned top to bottom how to start an ecommerce company for free from YouTube," she says.

She leveraged family connections to find a factory overseas that could produce masks, and she invested $3,000 in inventory and supplies. She started out slow, selling a few masks a week. But within a few months, she was selling 20 to 30 masks a week.

As the business continued to grow, she got a feel for what products her customers liked most and began selling them through Amazon and Walmart as well.

To keep the business viable long-term, Fu wants to branch out into other projects, she says. Because masks appeal to such a broad consumer base, she expects she'll need to sell a variety of products to continue to generate the same amount of income.

"Eventually, I want to have any products that a millennial would want, especially a trendy millennial," she says.

Building a better life

Success is important to Fu in part because of how she grew up. For her parents, "money was probably the number-one thing that was a stress factor," she says.

Fu was born in China, where her parents were educated and well-respected in their careers; her father was an engineer and her mother was a doctor. They moved to the U.S. when Fu was six, and found they were no longer able to use their degrees to get jobs, so they ended up working in grocery stores to make ends meet.

"I remember my dad told me when he was working at the grocery store, all of the workers were Asian and they all had master's degrees and PhDs," she says. "There were a lot of people struggling at the time."

"When you immigrate from China, it's already so difficult because you're judged based on how you look, your accent. Your education isn't valued as much as if [it were from the U.S.]," she says. "There are so many forces against you.

"It's tough to go through so much adversity and be hated on for [a pandemic] that has nothing to do with you just because you look a certain way."

Although her parents worked long hours, the family never had much. "Watching [my] parents struggle was really hard," Fu says. "Kids would make fun of me for wearing the same clothes every day. I only ever got clothes from thrift stores."

That's a major reason why she works so hard now. "Not succeeding was just not an option," she says. "Because we grew up like that, I never want that to be a problem in my future family."

Immigration status

Fu is in the U.S. on an O-1 visa, which cost her $6,020 to go through the application process. It's a tough visa to get, Fu says, because you have to prove that you're extraordinary.

Eligible candidates must show that they are "one of the small percentage who have arisen to the very top of the field," according to the U.S. Citizenship and Immigration Services website.

Fu plans to eventually become a U.S. citizen, but her background has complicated the process of obtaining a green card.

Fu and her family lived in the U.S. until she was eight, when they moved to Vancouver. Although she lived in Canada most of her life and is a Canadian citizen, when she decided to move back to the U.S. in 2015, the government considered her Chinese for immigration purposes.

As Fu explains it, the waitlist to obtain an EB-1 visa varies by country. She's part of the quota of immigrants from China, rather than those from Canada.

How she budgets

In 2020, Fu didn't take a salary from Millennials in Motion. She invested every dollar she made back into the company. To cover her living expenses, she relied on the salary from her consulting job and savings.

Here's a look at her expenses as of December 2020:

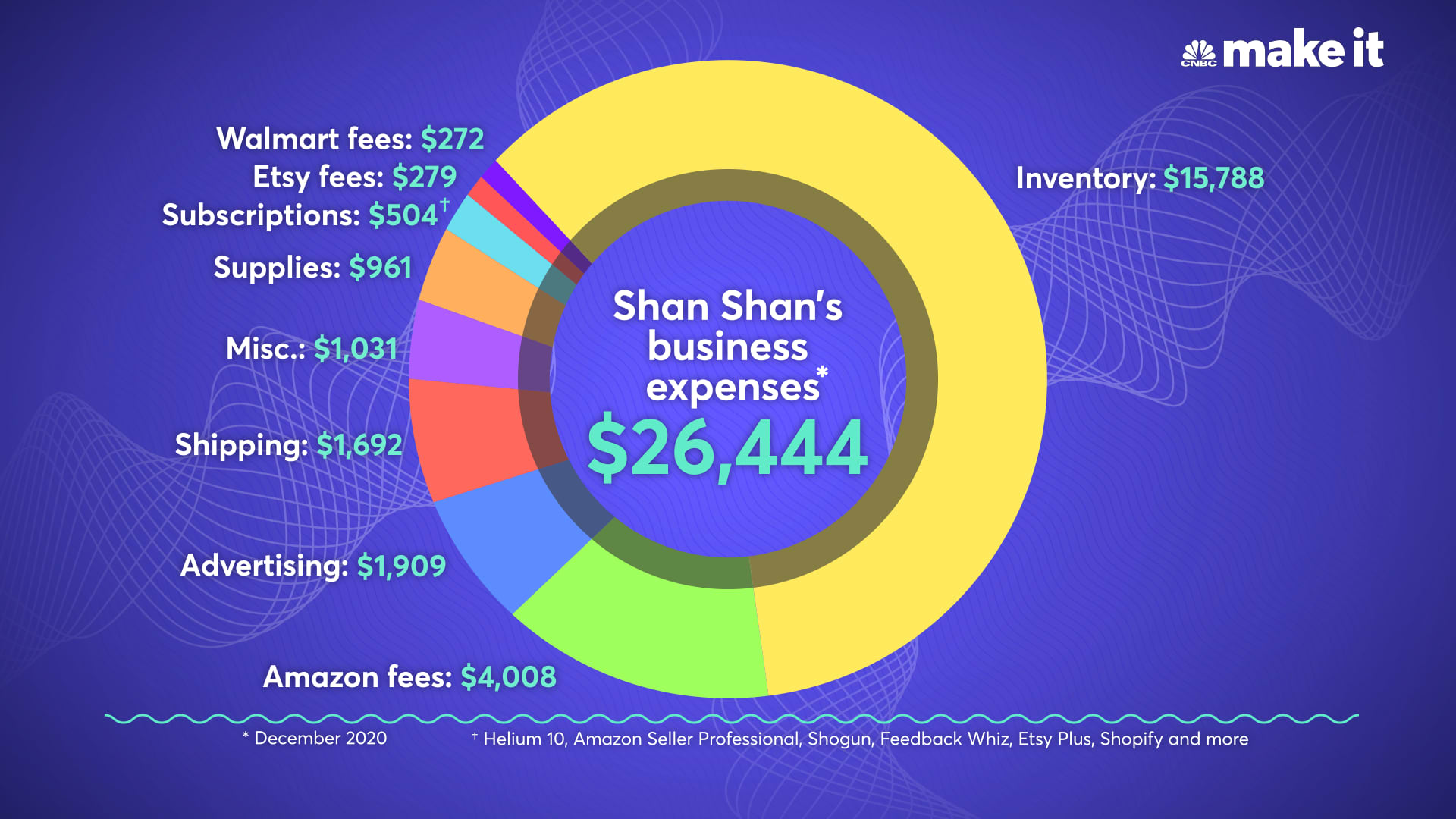

- Business expenses: $26,444

- Rent and utilities: $2,810 (her rent is $2,635; Wi-Fi, electricity, sewer and water runs another $175)

- Condo in Vancouver: $2,028 (includes the mortgage payment, homeowners insurance and HOA fees)

- Savings and investments: $2,000 (Fu aims to put $500 into her savings each month and invest $1,500 across her Roth IRA, traditional IRA, SIMPLE IRA and Robinhood accounts)

- Discretionary: $600 (includes dining out and household expenses)

- Insurance: $413 (includes health and renters)

- Groceries: $400 (includes $100 on HelloFresh boxes each month)

- Rideshare services: $200

- Phone: $115

- Subscriptions: $43 (includes Netflix, Spotify, YouTube TV and Disney+)

Here's how her business expenses break down for the same month:

- Inventory: $15,788

- Amazon fees: $4,008

- Advertising: $1,909

- Shipping: $1,692

- Miscellaneous: $1,031

- Supplies: $961

- Subscriptions: $504 (FeedbackWhiz, Shogun, Helium 10, eRank, Canva, ShipStation and more)

- Etsy fees: $279

- Walmart fees: $272

In her 20s, while living in Vancouver, Fu worked at a digital agency where she could earn unlimited commission. She found herself socking away all of her extra cash without any plan for it, so she decided to dive into real estate.

Fu found a property stacked with amenities, including a communal rooftop and lounge, that overlooked downtown Vancouver. "I knew this was the millennial dream, so I purchased a condo there," she says. "Since then, it's almost doubled in value."

Fu purchased the home in 2014 for $500,000. She put down $100,000, or 20%, using the commission money she'd saved.

Because she wants to stay in the U.S. long-term, Fu has no plans to make the Vancouver condo her primary residence and eventually, she would like to sell it. For now, she continues to pay the mortgage, HOA fees and homeowners insurance.

Another one of Fu's largest monthly expenses is the rent on her one-bedroom apartment in San Francisco. "As a child, a lot of the time, I lived in cold, dark basements and now as [an adult] that is the last thing I want," she says. Now, "I want to live in a place that is beautiful because I work from here, I entertain from here, I live here."

Fu previously lived in a studio apartment in the same building and she paid $3,039 a month in rent. But when the pandemic hit and people started fleeing San Francisco, she was able to negotiate an upgraded apartment and discounted rent.

Millionaire mindset

YouTube didn't just show Fu how to run a business; it also introduced her to the FIRE movement, which focuses on financial independence and retiring early. The idea of becoming financially independent resonated with Fu, although she doesn't plan to stop working anytime soon.

Instead, she's interested in the flexibility financial independence offers. "With that flexibility, I can do consulting for companies. I can help others build their business. I can even go into the creative. I've always wanted to write books," she says.

She's well on her way to achieving those financial goals. Fu hopes to double Millennials in Motion's revenue in 2021, which would allow her to outsource more. That would free Fu up to focus on strategy and growth, as well as allow her more time to branch out into new projects.

Eventually, she'd also like to buy more real estate as an additional stream of passive income.

Fu's other big goal: become a millionaire by 36. And with a current net worth of around $700,000, not including the valuation of her company, she's on track.

"Back when I worked at the consulting firm, I saw money as a finite resource. But now that I started Millennials in Motion, I see it as an infinite resource," she says. "You can always make more.

"That has made me more relaxed and made me feel not as much pressure, because I know that I have the skills now to make as much money as I want, whenever I want."

Are you a millennial turning 40 this year? Share your story with us for a chance to be featured in a future installment.

Check out: Use this calculator to see exactly how much your third coronavirus stimulus check could be worth

Don't miss: The budget breakdown of a 29-year-old nanny earning $175,000 in NYC and Georgia