The Biden administration announced up to $20,000 in student debt forgiveness for people with Pell Grants, and $10,000 for those without Pell Grants. While it’s not full forgiveness that many activists have demanded, “it’s a big deal,” says Sabrina Calazans, director of outreach at the Student Debt Crisis Center. She joins LX News to discuss how this plan will affect millions of borrowers.

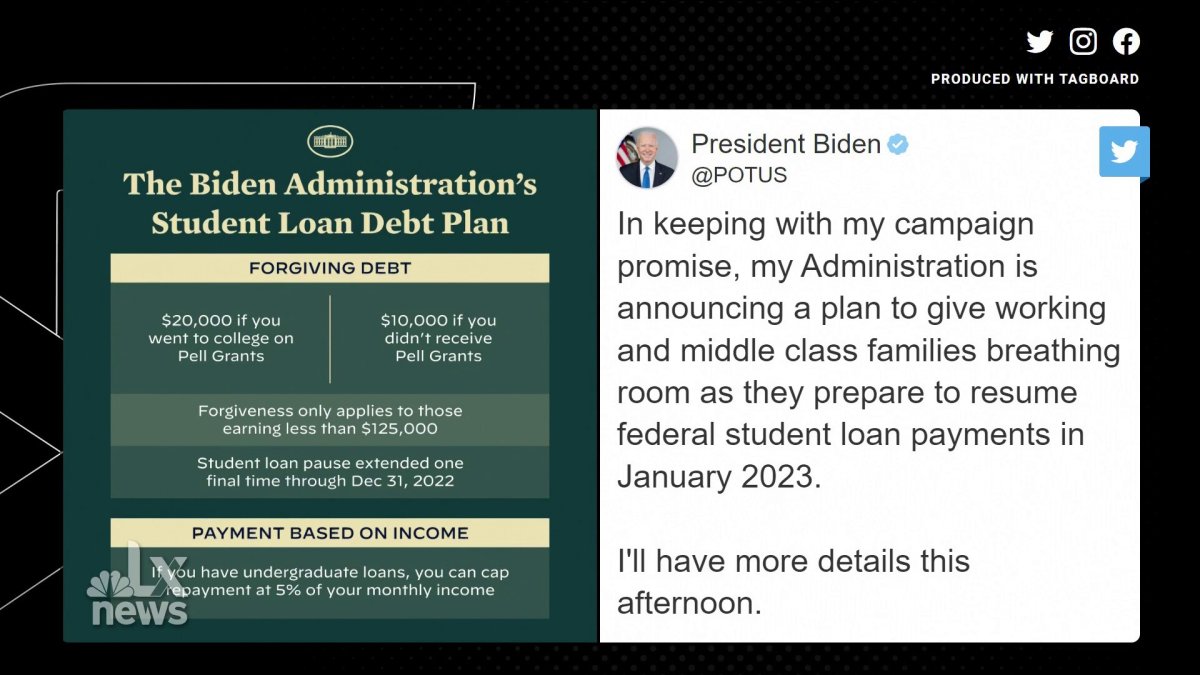

President Joe Biden announced plans to cancel $10,000 in federal student loans for millions of borrowers, delivering on a promise touted on the campaign trail.

"In keeping with my campaign promise, my Administration is announcing a plan to give working and middle class families breathing room as they prepare to resume federal student loan payments in January 2023," the president said Wednesday in a tweet.

The debt cancellation will be eligible for borrowers who earn less than $125,000 a year, or $250,000 for couples who file taxes jointly.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

Pell Grant recipients, who make up the majority of student loan borrowers, will be eligible for an additional $10,000 in debt relief, for a total of $20,000.

What's the average amount of federal student loan debt in Florida?

According to a report by Education Data Initiative from April 3, Florida residents have a collective amount of $100.9 billion in student loan debt.

Local

The average amount of federal student loan debt that Floridians owe sits at a whopping $38,459.

With nearly 22 million residents in Florida, more than 2.6 million of them have student loan debt and almost half are under the age of 35, the report said.

Among Florida's indebted student borrowers, the Education Data Initiative reports that 15.7 percent owe less than $5,000, 20.7 percent owe between $20,000 and $40,000, and about 2.7% owe more than $200,000.

If you have student loan debt and want to find out if you are eligible for loan forgiveness or how to apply, click here.