Most Americans believe they'll need to save up at least $1 million to retire comfortably. But depending on where you plan to spend your post-work years, that may or may not be enough money to sustain you.

If you plan on retiring in the United States, it's helpful to get an idea of how far you'll be able to stretch your retirement funds in different states. Retirement can often last 25 years or more, according to Fidelity, but in states with high costs of living, $1 million may not be enough to cover your expenses for that long.

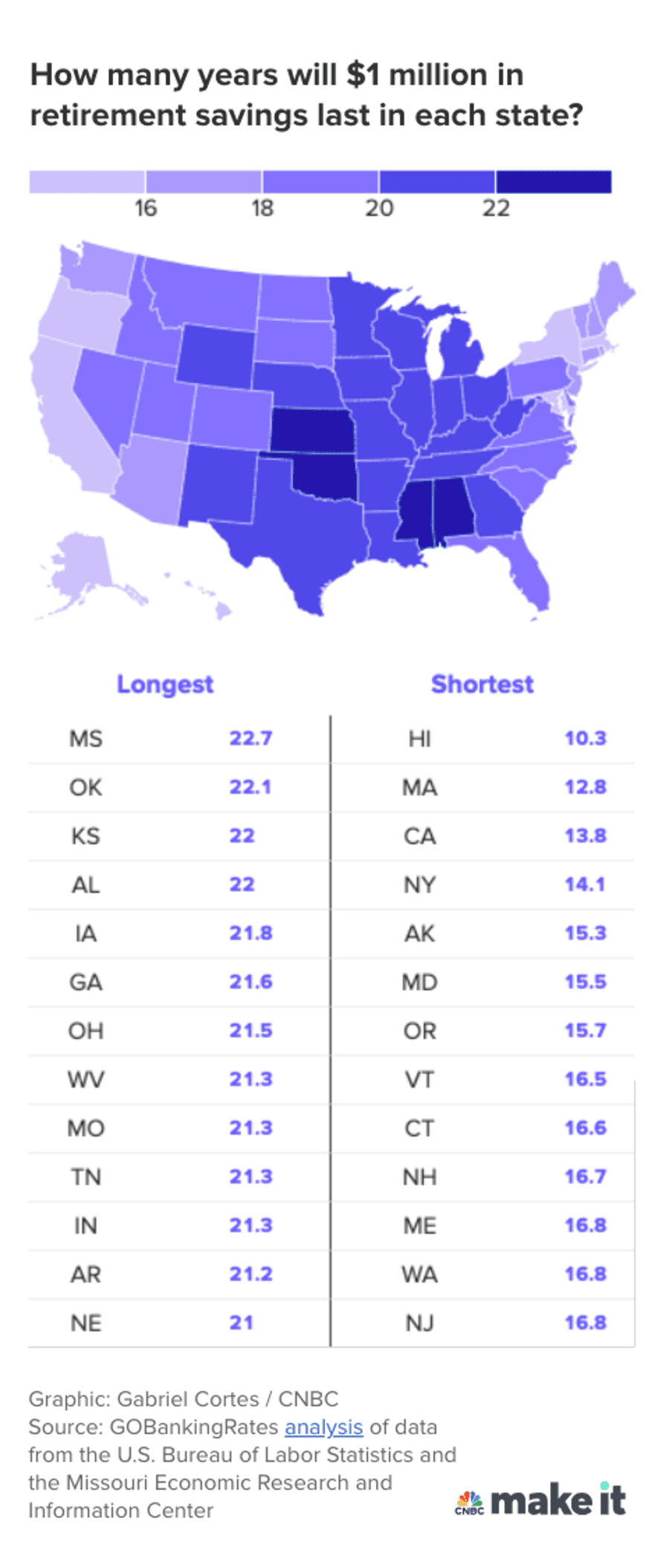

GoBankingRates took a look at how long $1 million would last in every state and found it wouldn't be enough to cover 25 years of retirement expenses anywhere in the U.S.

The analysis assumed a retirement age of 65 or older and examined annual living costs in all 50 states including expenses for housing, utilities, groceries, health care and transportation. GoBankingRates used the latest available data from the Bureau of Labor Statistics' 2020 Consumer Expenditure Survey and the Missouri Economic Research and Information Center.

The Hurricane season is on. Our meteorologists are ready. Sign up for the NBC 6 Weather newsletter to get the latest forecast in your inbox.

In Florida, $1 million would last you about 18 years, per GoBankingRates' December study. And in Hawaii, that amount would run out after around 10 years — the shortest amount of time out of every state.

On the other hand, $1 million would last you the longest period of time in Mississippi at around 22 years, the study finds. The Magnolia State also ranked as Bankrate's fifth best state to retire due to its affordability and weather, but didn't score well in the health care and overall well-being categories.

Here's how long $1 million in retirement savings lasts in every state.

Money Report

When it comes to retirement, it appears that $1 million doesn't go as far as it used to since the value of money can decrease over time due to factors like inflation.

For example, $1 million would've lasted you around 20 years in Florida, according to GoBankingRates' 2022 analysis. And it would've stretched for a little over 25 years in Mississippi, per last year's study.

But don't be too discouraged — a "comfortable" retirement will look different for everyone. How much money you'll need during that stage of your life will depend on personal factors such as whether you want to move closer to family or how often you plan to travel.

Regardless of whether you want to retire as a millionaire or not, it's helpful to have a clear savings goal in mind. CNBC Make It's retirement calculator uses things like your age, income and current savings to give you an idea of how much money you may need to save up in order to maintain your desired lifestyle in retirement.

Once you have your target amount, you can put a plan in place to help you reach that goal.

Fidelity recommends aiming to put around 15% of your annual income toward retirement, inclusive of your employer's match. But it's OK if you can't contribute that much right away. Instead, start with what you can and then increase your savings rate by 1% each year until you reach the 15% savings rate, Fidelity says.

"While market conditions are constantly changing, the benefit of making consistent contributions over the long-run is clear—a more secure retirement," Rita Assaf, head of Fidelity's Retirement Products, says in their "Q3 2023 Retirement Analysis."

DON'T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Get CNBC's free Warren Buffett Guide to Investing, which distills the billionaire's No. 1 best piece of advice for regular investors, do's and don'ts, and three key investing principles into a clear and simple guidebook.

CHECK OUT: Want to retire with $5 million? Here's how much to save each month