A key deadline is approaching fast for an opportunity for a student loan cancellation.

If you are a federal student loan borrower you could have the chance to receive a full cancellation of your debt or credit towards cancellation through a one-time U.S. Department of Education payment-count adjustment. But to be eligible you might have to first consolidate your loans.

And you must take that step by Tuesday, April 30.

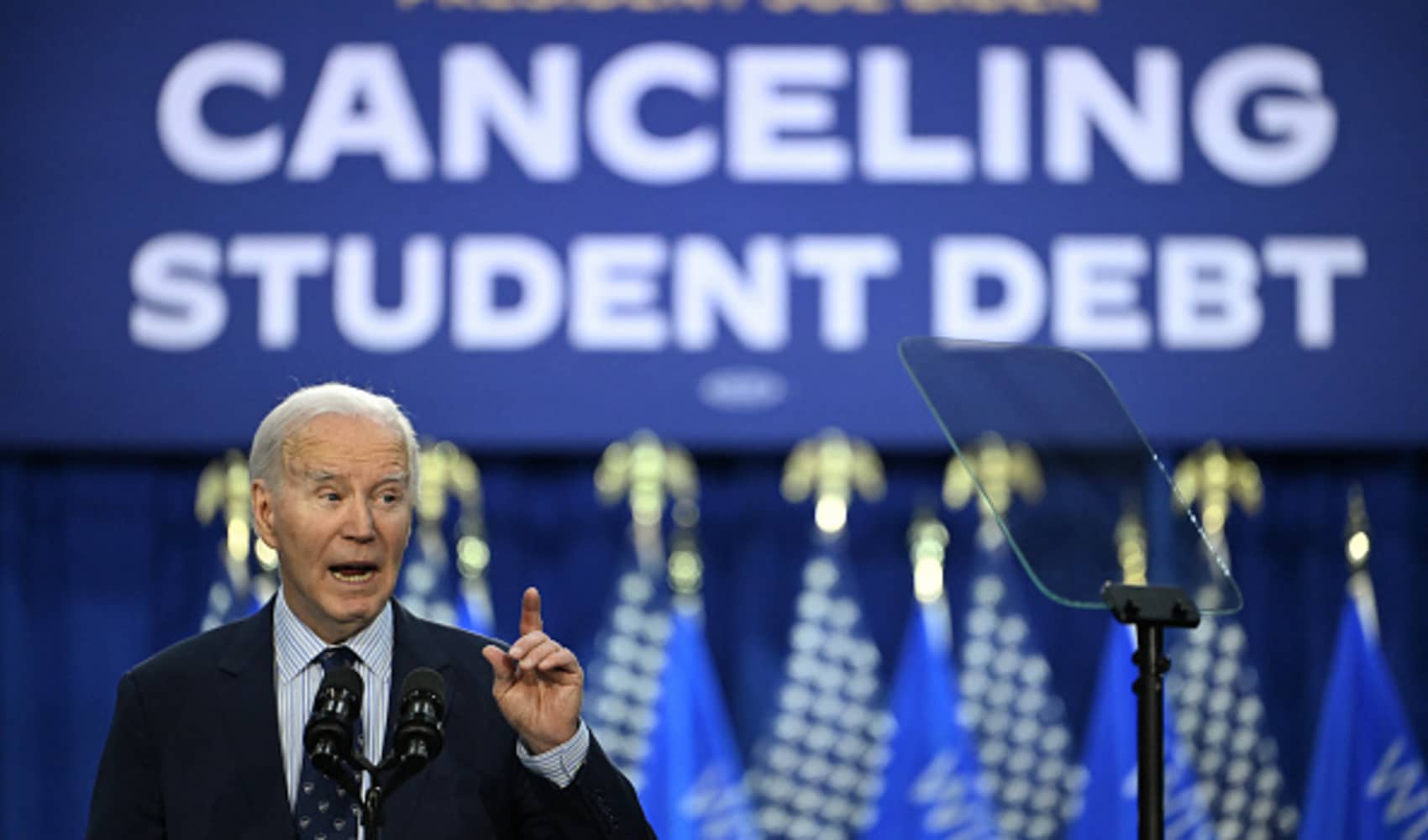

The Biden administration is cancelling federal student debt for millions of undergraduate or graduate students and providing some relief to millions of others. In all more than 30 million Americans will benefit, according to NBC News.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

More than four million borrowers will have the full amount of their student debt cancelled, 10 million will be eligible for at least $5,000 in debt relief and 23 million borrowers will see their accrued interest eliminated.

The U.S. Department of Education will make the one-time adjustment over summer.

Here’s what you need to know.

US & World

What loans must be consolidated?

If you have any of the federally managed loans that are listed here, you must consolidate them to get the most credit toward loan cancellation.

- Commercially held Federal Education Loans or FFELs.

- Parent PLUS loans

- Perkins loans

- Health Education Assistance Loan Program or HEAL loans

If you are not sure about what kind of loan you have, log in to your account at StudentAid.gov or call the U.S. Department of Education’s Federal Student Aid Information Center at 1-800-433-3243.

Your new Direct Consolidation Loan will be eligible for the one-time adjustment this summer.

When is the deadline to consolidate?

Tuesday, April 30.

In the News

How do I apply to consolidate my loans?

Sign on to StudentAid.gov/loan-consolidation to choose the loans you want to consolidate and determine a monthly repayment plan for your new loan. You can also get help at the Federal Student Aid Information Center at 1-800-433-3243.

There is no application fee.

Some special details about Parent PLUS loans

If you have made at least 25 years or 300 months of repayment toward your Parent PLUS loan managed by the U.S. Department of Education, your loan will be cancelled automatically as part of the one-time adjustment. Otherwise you should consolidate the loan.