A judge Tuesday approved a settlement among parties with the most money at stake in what lawsuits allege was a long-running real estate fraud in Coconut Grove.

But the $33 million deal omits those who put $20 million down on homes and lots where, their lawsuits allege, the developer fraudulently delayed completion while collecting multiple deposits and obtaining loans on the same properties.

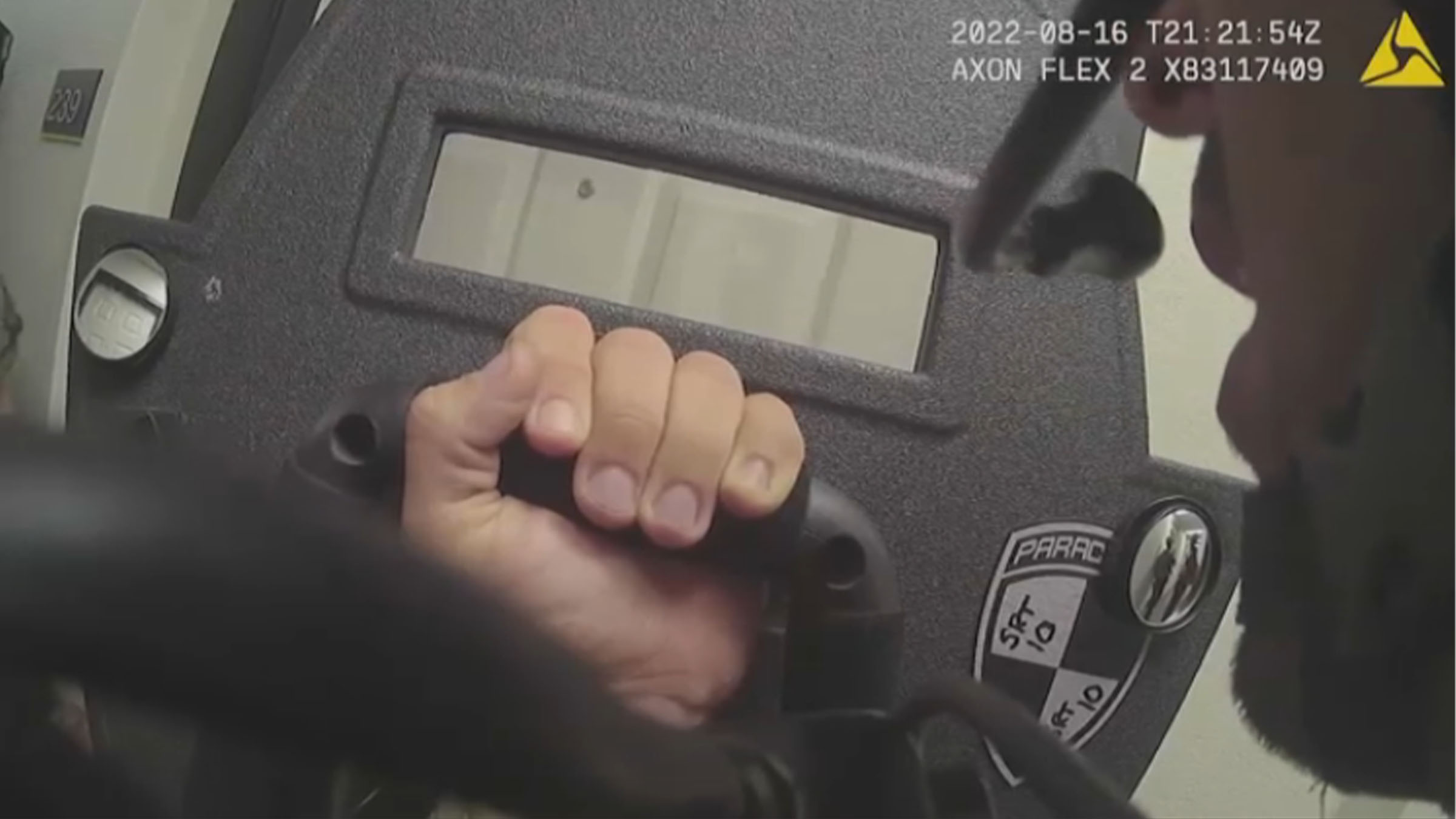

NBC6 first exposed complaints from the homeowners last year.

The settlement, approved by Miami-Dade Circuit Judge Thomas Rebull, resolved the biggest financial claim, made by Altamar Financial Group LLC. As of last month, Altamar was arguing it was owed $48 million in principal and interest on loans made to the developer, Send Enterprises, according to the motion to approve the settlement. At 24.5% interest, the balance was increasing by $670,000 a month, said Alan Fine, the receiver appointed by the court to take control of the developer’s companies.

Get South Florida local news, weather forecasts and entertainment stories to your inbox. Sign up for NBC South Florida newsletters.

Instead, Altamar will accept about $33 million – half of it from a planned $16.5 million sale of 12 vacant lots that had been acquired by the companies, which were run by Douglas Cox and attorney Nicole Pearl.

The purchaser of those lots will now lend the receiver another approximately $16.5 million, which would be used to complete the payout to Altamar.

In exchange, the Altamar is dropping all its claims and its appeal challenging the sale of the lots.

Investigations

The NBC 6 Investigators get results

Fine, the receiver, will now market and sell the 14 substantially completed townhomes and one single-family house that’s about two-thirds completed. Those proceeds will be first used to pay back principal and interest on the $16.5 million loan from the purchaser of the vacant lots. And the receiver will continue to seek damages from Cox, Pearl, Pearl’s law firm and others involved in their alleged scheme, while defending against nearly $21 million in claims from investors in and lenders to the companies once controlled by Cox and Pearl.

A lawyer for the couple has declined comment.

After covering the costs and fees of the receivership – already more than $1 million -- whatever money remains from the sales and judgments the receiver may obtain against others involved will go to the people who put up more than $20 million in down payments on the properties.

The settlement was hammered out last month in a 15-hour mediation led by retired Judge Michael Hanzman, who while still on the bench oversaw the landmark $1.2 billion settlement resolving the Surfside condo collapse litigation.