‘You're gonna see a change': Lauderhill launching initiative to curb gun violence

Lauderhill is launching what it calls a movement to change the culture of violence.

-

Elementary school students speak out after adults attack them in Miami

Two students spoke out about the scary moments two adults attacked them not far from their elementary school in Miami.

-

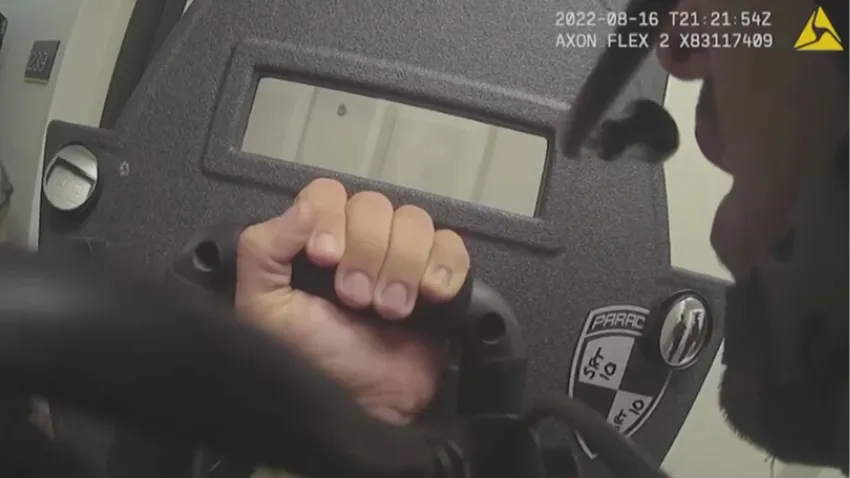

Bodycam video raises questions about police raid inside hotel room in Miami Springs

An officer shot and killed a man inside his hotel room, in front of his children. Police say he was a suspect in an armed robbery.

-

Woman injured in fatal Fort Lauderdale crane collapse files $50M negligence suit

A woman who was injured when parts of a crane and construction materials fell from a Fort Lauderdale high-rise project onto the car she was in earlier this month has filed a $50 million-plus negligenc... -

Looking for a staycation? These Miami hotels are now Michelin-honored

The Michelin Guide has revealed its brand new list of the most outstanding hotels in the country, and several Miami hotels were honored.